As a kid, I had no aspirations of being a business owner or entrepreneur.

I was a baseball card collector investing way too much money in Jose Canseco baseball cards. (That probably ranks as one of the worst investments I’ve ever made, but, hey – I was just a kid).

Even going into college, I really didn’t know what I wanted to do when I graduated.

I majored in finance because my dad thought it would be a good major, and I kind of liked numbers.

The self-employment revelation hit me when I read Robert Kiyosaki’s Rich Dad Poor Dad. That really changed my whole mindset and got me thinking seriously about becoming an entrepreneur.

After graduation, I was attracted to the financial services industry because I felt that the income potential there was unlimited. I put in my time doing cold calling seminars – and doing anything else I needed to do to get clients. All went well for the first five years – or so it seemed.

Then another revelation hit me: Even though my income was unlimited, I was still a W2 employee.

That wasn’t exactly the message of Rich Dad Poor Dad, but it did have certain advantages. After all, I didn’t have to worry about who was paying the rent, how much the phone bill was, or what would happen if my computer became outdated. My old brokerage firm took care of all that responsibility.

But in the end, that arrangement wasn’t as cozy as it seemed.

Table of Contents

My brokerage firm was bought out, creating one of those moments that almost forced you to change direction, and that‘s what I did. I and three other coworkers took the leap of faith of actually starting our own financial services firm. I was finally – and officially – crossing over from W2 employee status to legitimate business owner.

I was finally self-employed.

It definitely was very exciting, but it was also very scary. I quickly realized I knew nothing about running a business. Sure, I knew how to make cold calls, get new clients, and schmooze with the best of them. But actually running a business was something that I had never been taught in school and really had no experience with.

I’m proud to say that it’s been six years since I made that bold and daring move, and things have worked out like you wouldn’t believe. This is one of those situations where you ask yourself: Why didn’t I start my own business sooner?

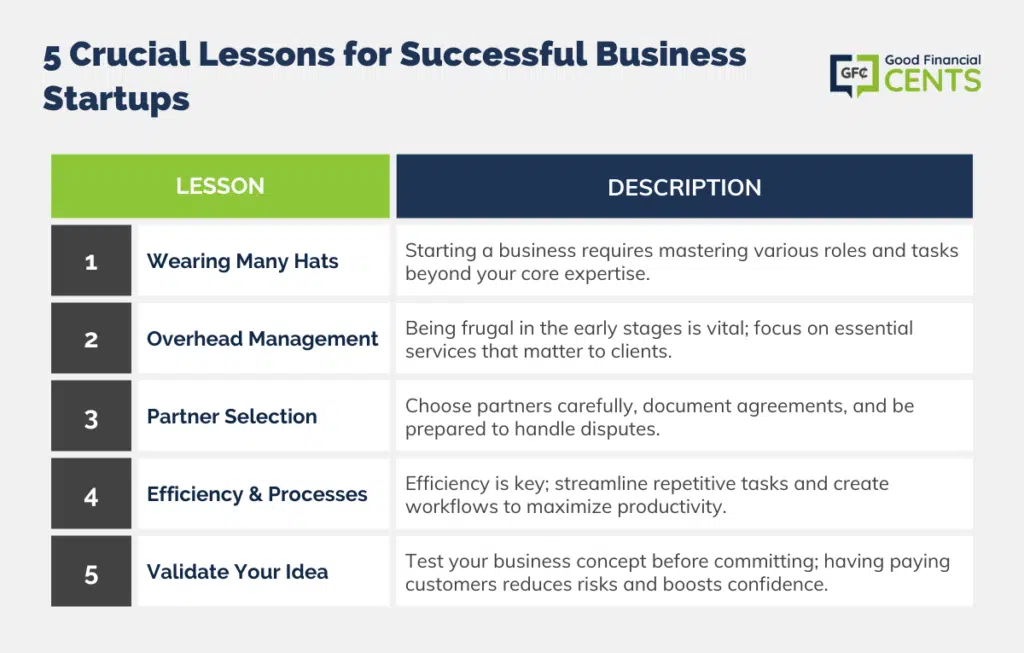

Here’s what I’ve learned in starting and running my own business – maybe these lessons will help you to start your own venture…

1. You Wear a Lot of Hats.

I think I first became aware of this from Michael Gerber’s book, The E-Myth. Gerber talks about how difficult it is for anyone to run a business and that it goes way beyond just being “good“ at what you do. For example, let’s say that you’re a plumber, and a great one at that – what do you know about marketing your business, pricing your services, ordering equipment, and managing employees?

That’s where most business owners fail.

When it came to starting our business, we had to find a suitable place to rent and choose and buy office equipment at affordable prices. We had to learn to market ourselves – no small feat since we were a brand–new company that no one knew existed. We also had to hire staff and train them to learn our processes.

And we had to do all of this while servicing our existing clients in a way that would make the transition smooth and painless.

Every business is different, including the initial rollout. But the point is, self-employment requires wearing a lot of hats that you don’t need to concern yourself with when you’re on someone else’s payroll. There’s a learning curve involved, and you have to master it in order to succeed. That means learning the various jobs, skills, and tasks that you need in order to make your business work.

2. Overhead Can Kill You.

At my old brokerage firm, we had impressive features, like premium office space, high–end furniture, expensive pictures on the walls, and a streaming live quote system that could show what 100-plus stocks were doing at any time of the day. All that stuff costs money, and when you start a new business, that’s something that’s in short supply.

But here’s what I learned: Frugality is a virtue when starting a new business.

When you start a business, you have to think “shoestring,” and that means finding less expensive ways to do everything. It might even mean doing without a few things. It’s your basic business service that matters most and draws in clients. The rest is mostly window dressing that clients and potential clients may not even notice. Let me give you some examples.

We looked into that streaming stock quote system from the old broker; it costs $300 per month, and that would create instant overhead. But the exact same information could be had on Yahoo Finance for free! Needless to say, we didn’t sign up for the streaming stock quote system.

We needed a sign for our building. We found one with flashing LED lights that would be really perfect – but it cost roughly $30,000. It’s not going to happen! Instead, we settled on a sign that could light up at night only but cost just $3,400. That‘s roughly 10% of what the deluxe sign would have cost.

In the end, it didn’t matter all that much. People aren’t buying your sign – they’re buying your service.

Businesses fail for a lack of positive cash flow more than anything else. The sooner your business starts generating that positive cash flow, the greater your chance of business success. You can give yourself a big, fat advantage by determining from the get–go that you won’t spend money on stuff you don’t absolutely need.

3. Select Your Partners Carefully.

We went into our business as a partnership, and that always presents special challenges. My partners were three financial advisors from our former brokerage firm, so we all knew one another on a professional basis. We agreed on how the partnership would be run in advance, including that any major business decisions would require a unanimous voting process.

These weren’t necessarily people I would hang out with after work, but all were individuals I felt I could trust and who I felt comfortable with on a professional level. It is, after all, a business, so the reasons for having these people as partners were more about business concerns than social factors.

We also committed our partnership agreement to writing. Partnerships don’t always work out, so you have to have written procedures on how to run the business, how to settle disputes, and, if necessary, how to handle the departure of one of the partners.

If you’re a sole proprietor, the partnership issue won’t apply to you directly. But anytime you start a business, you will be involved in all kinds of loose and informal partnerships with people you need to rely on. They can be suppliers, vendors, contractors, or even major clients. Choose them all wisely, understanding that a bad relationship has the potential to sabotage your business.

4. Work on Being Efficient. Start Processes.

The biggest key to running virtually any business successfully is your ability to concentrate most of your time and effort on the activities that will bring in the most money. That means that you have to minimize the time spent on routine functions.

This is especially true for any service-related industry. Any tasks that are repetitious have to be streamlined so that you won’t be performing them over and over again. We had to come up with processes in our office that would minimize paperwork and administrative tasks.

Personally, I hate doing that kind of work, so we had to create a process flow that would make these as simple as possible. Some of the functions include accepting client checks, making bank deposits, opening new accounts, and conducting annual reviews with existing clients.

You need to identify repetitious functions early in your business and streamline them immediately.

This is particularly important when starting your business because building a cash flow has to be your top priority. You have to create a workflow that maximizes efficiency and enables you to establish that process throughout your business from the very beginning.

5. Make Sure You Have Some Paying Customers First.

I get dozens of emails from financial advisors across the country who want to start their own practice, probably from reading my posts about the steps I went through in starting my own financial planning practice. What many of these advisors might not realize is that I was in the business for five years before I decided to go out on my own.

Could I have accomplished it sooner?

Before you actually start a business, you might want to test it and treat it more like a side hustle. Keep your day job and just see if your business idea has roots. Test it out with family and friends. Test it out with your network. Find out if you actually have something that people are going to pay money for on an ongoing basis.

If you can do that, then at least 51% of the risk will be removed from your business. Not only will you have a cash flow going in, but you’ll also have the benefit of having the confidence that comes from knowing you have it. That may be the single best piece of advice I can give!

Final Thoughts – 5 Crucial Lessons I Learned by Starting My Own Business

Embarking on the journey of starting my own business has been a profound learning experience, one that has reshaped my life in unexpected ways. Reflecting on this path, I’ve distilled five crucial lessons that have guided me through the highs and lows of entrepreneurship.

In my six years as a business owner, these lessons have been invaluable. They serve as a testament to the transformative power of self-employment, a journey that demands continuous learning, adaptability, and perseverance.

If you’re considering starting your own business, I hope these insights prove helpful in your entrepreneurial endeavors.

I think point no. 5 on your list is so crucial. I am a marketeer by profession but realised by growing interest and passion for personal finance.

Recently, I became a Certified Financial Planner, though my job is still as a marketeer in a bank. I have been at odds as to how to structure the business and start a practice.

I have come to the conclusion that for now I need some hands on experience handling clients’ money and trying to figure out such a role.

Creating processes has helped me very much, especially because repeated actions become more efficient and eventually take less time and thought to complete, allowing me to either grow and improve those tasks or use the additional time for other tasks.

100% agree with point number 4. Time and energy are the most important building blocks for startups, in my opinion, and maximized efficiency can help you prioritize the money-making activities a lot more successfully.

Partnerships do present some challenges especially when an agreement isn’t written out in detail. Whenever, I start a collaboration/partnership I prefer a detailed accounting of responsibilities. Most will state it isn’t necessary which baffles me.

When I was a kid I never wanted to own a business either. I don’t know how but the idea of owning my own business became synonymous with the business OWNING MY LIFE.

It’s been a tough meme to crack, for me too. But I’m gettin there.

The book that got me started was What I didn’t Learn at School But Wish I had by Jamie McIntyre. Rich Dad Poor Dad is a great one too!

Amen and then some to all of those points. Great info thanks for sharing and kudos on all of your success.