In many cases – especially for those who are young and in good health – a term life insurance policy is typically considered.

There are several reasons for this.

First, term is usually the most affordable form of life insurance coverage on the market.

This is because term life coverage includes only pure death benefit protection – without any type of cash value or investment component.

What most people do not know is that term policies can also be good for people in poor health and you could find a no medical exam life insurance policy that will be easier for you to qualify for.

Quick Navigation

- Term Life Insurance Options

- Types of Term Life Policies

- How and Where to Obtain Term Life Insurance

- How Much Term Life Insurance Do I Need?

Term Life Insurance “Term” Options

With term insurance coverage, policies are purchased for certain set time limits, or “terms.”

For example, policies typically have terms of:

Once a term policy has expired, the insured will typically have to re-qualify for coverage if he or she wants to renew their coverage.

This re-qualification will be based on the insured’s then-current age and health condition.

Because of this, the premium that is charged on the new policy will typically be higher.

Term can be considered a good type of life insurance coverage for those who are covering “temporary” needs.

Example

Therefore, they could purchase a 30-year policy with a death benefit in the amount of the mortgage balance.

In this scenario, the policy will expire at the same time that the mortgage balance will be paid off.

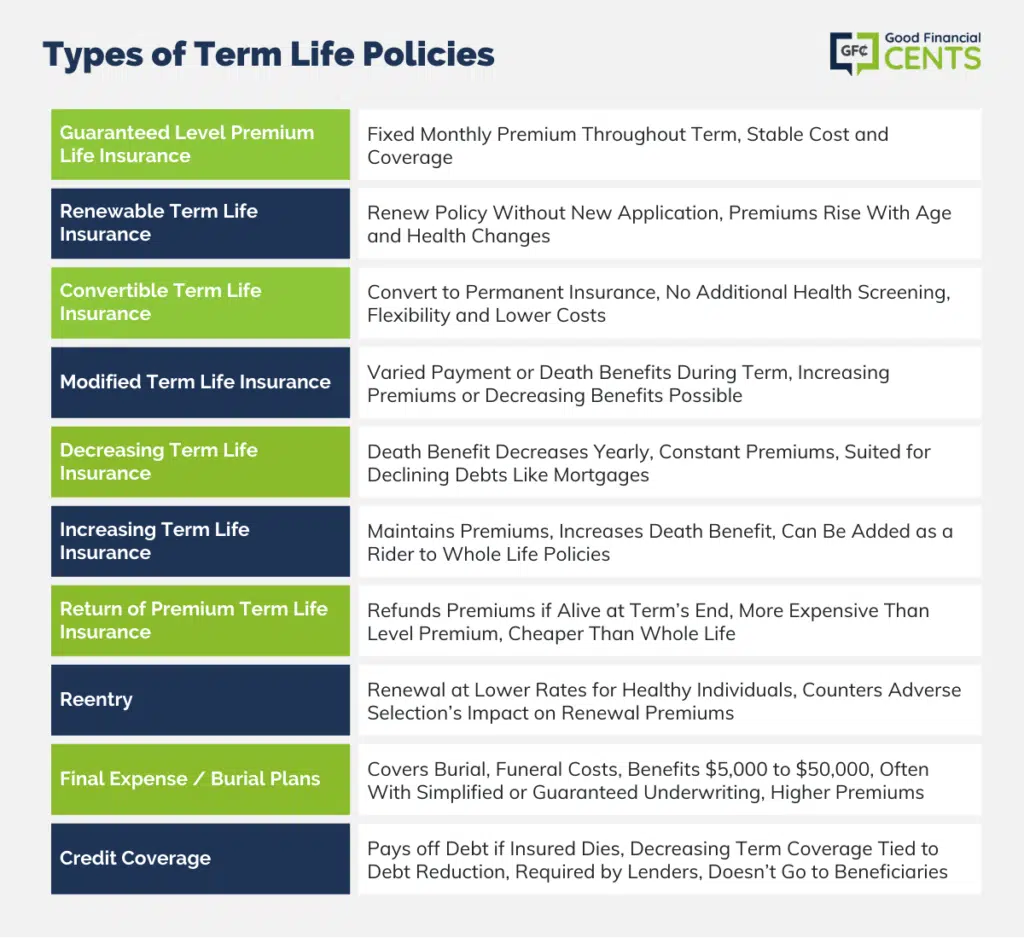

Types of Term Life Policies

Depending on which options you choose, you can notice that there are very different costs to the premiums on your term insurance quotes.

There are several different types of term policies on the market – some are even specific to certain protection needs and those different options can lead to very different premiums when the term life quotes are pulled.

Premiums on life insurance for smokers can look different as well.

There are several features of term life policies to understand that explain the general types of term life insurance policies available:

Guaranteed Level Premium Life Insurance

The most common term life insurance policy is guaranteed level premium.

This type of policy guarantees that the monthly premium will never change for the entire term of the policy.

So, if the policy is for a 30-year term at a guaranteed premium of $25 per month, that will never change for the entire life of the policy.

Other types of policies might offer premium amounts that change over time or benefits that change over time.

Renewable Term Life Insurance

With the renewable term, the policy can be renewed by the insured after each time period – or term – has elapsed.

The policyholder can do so without the need to complete a new application for coverage or to pass a physical exam.

Although the policyholder is allowed to renew the policy, a new term quote will be run and the premium on the plan will likely increase at each renewal.

This is due to the insured’s older age and possible adverse health conditions.

Convertible Term Life Insurance

A convertible policy allows the insured to convert a term life insurance policy to a permanent life insurance policy at a later date.

As long as the conditions of the policy have been maintained and premium payments have been made, the insured will not be required to undergo any new or additional health screening at the time the policy is converted – regardless of their medical condition.

The convertible term allows the policyholder the advantage of obtaining less expensive coverage, while still maintaining the option to convert to a permanent policy at a later time in the future as their insurance and financial needs may change.

Also, they do not have to go through the process of getting a new quote.

Modified Term Life Insurance

A modified policy is any variation of payment structure or death benefit during the term of the policy.

Some modified policies offer increasing premium amounts over time or decreasing death benefits over time depending on the need.

Decreasing Term Life Insurance

With a decreasing policy, the death benefit decreases each year, even though the premium remains the same.

The decreasing term life policy will end when the death benefit reaches zero.

Potential purchasers of decreasing term life insurance may be those who want to cover the amount of their unpaid mortgage balance.

In this case, as the amount of the mortgage balance decreases, so too does the amount of death benefit on the decreasing term coverage.

Increasing Term Life Insurance

Increasing term insurance policies maintain the same premium throughout the term, but has an increasing amount of death benefit.

This type of benefit can oftentimes be purchased as a cost of living rider to a whole life policy.

Return of Premium Term Life Insurance

One of the downsides of term life insurance is reaching the end of the term and having it just expire or having the premium drastically increase to keep the policy intact.

Return of premium insurance is designed to pay the premiums back in the event you’re still alive at the end of the term.

This feature does cost more than a guaranteed level premium, but it actually costs less than a whole life policy.

The major difference is the policyholder doesn’t earn any growth on the premiums over the years.

Reentry

Life insurance companies typically charge low premiums in the first few years after issuing a term policy because they have screened their applicants and selected only those who are in relatively good health.

On average, insureds tend to remain in good health for the first few years after policies are issued.

However, throughout the years, the pattern is that some policyholders who are in good health will drop their coverage while others who are in poor health will keep theirs.

In order to help in offsetting this trend, insurers need to build additional renewal premium charges into the policy in later years to help in covering the additional mortality cost that is associated with this adverse selection.

If an individual is in good health, then he or she may apply for new insurance by showing evidence of insurability, and they can once again enjoy the lower mortality charges that are associated with the newly issued policy.

Therefore, some insurers offer reentry term life insurance policies.

As long as an insured continues to show evidence of insurability at periodic intervals, their renewal premiums – which are based on lower mortality charges – will remain comparable to the premiums for newly issued term policies.

Likewise, if the insured is not able to qualify for the lower premium, most policies will also include a maximum amount of premium that could be charged.

These maximum renewal premiums are higher than the renewal premiums that are charged for a regular renewable term.

Final Expense / Burial Plans

Final expense insurance is a type of coverage that covers the cost of burial, a funeral, and other related costs.

Often referred to as “funeral insurance” or “burial insurance,” final expense generally provides a benefit of between $5,000 and $50,000.

The policyholder on final expense life insurance can name a person (or persons) of their choice as the beneficiary.

The beneficiary – in many cases a family member or other loved one – makes the life insurance claim upon the insured’s death and is then responsible for using the proceeds to carry out the policy holder’s wishes.

Many final expense life insurance policies are offered at a lower cost than more traditional forms of life insurance coverage – and final expense plans can allow the policyholder to make affordable monthly or annual premium payments.

This makes final expense coverage easy to carry for many – even those on a fixed budget.

In many cases, final expense policies are underwritten as either “simplified issue” or “guaranteed issue.”

With a simplified issue policy, the applicant is asked several questions regarding their health and medical condition.

However, the applicant is not required to take a medical exam.

A guaranteed issue policy in one in which the applicant is not asked any medical questions at all. Therefore, with these types of plans, anyone who applies will receive coverage.

It is important to note, however, that the premiums on these policies are typically higher.

Credit Coverage

Credit life insurance is a type of policy that is designed to pay off a person’s debt should the debtor pass away.

The face value amount of the insurance policy typically will decrease as the balance of the debt goes down – until both reach zero.

Credit life insurance can protect an individual’s dependents in that they will not be saddled with debt should the borrower die prior to paying off the balance.

In some cases, the purchase of a credit policy is required by a lender prior to loan or credit approval.

Some of the key features of credit life include:

- Policies insure the lives of a debtor for the benefit of a creditor

- Purchased on either an individual or group basis

- Policies are usually decreasing term coverage

- Death benefit proceeds cannot exceed the amount of the indebtedness

- The lender or creditor must apply the death benefit proceeds towards discharging of the loan

- Premiums usually are added to the debtor’s loan installment payments

- The insured is given a Certificate of Insurance

- The borrower’s coverage will terminate when the debt is paid off, refinanced, transferred, or becomes significantly overdue

Credit policies can also offer a way to obtain coverage to those who are unable to obtain it in any other way.

Although proceeds do not go to the insured’s loved ones, credit life will help in reducing a decedent’s debts, which can help in avoiding financial hardship for the insured’s survivors.

How and Where to Obtain Term Life Insurance

In order to obtain the best term life insurance for your needs, it is usually a good idea to work with a company that has access to more than just one insurance company.

This is because you will be able to compare several different policies and their corresponding premium prices.

When you’re ready to start shopping for coverage, we can help.

We work with many of the top life insurers in the market place, we can also direct you to the best life insurance rates for smokers.

We can help you to obtain all of the information that you need quickly, easily, and conveniently, directly from your computer and without the need to meet in person with a life insurance agent.

Quotes can be viewed online – and when you’re ready to purchase, you can also submit your information via the Internet as well.

If you are ready to begin the process of purchasing term life insurance from one of the top life insurance companies, just simply fill out and submit the form on this page.

We all know that getting life insurance can be a big decision.

There is a great deal of information available – and at times, it can almost seem overwhelming.

But making sure that you have your family in a secure financial footing – no matter what the circumstances – is worth the short term process of getting a policy.

How Much Term Life Insurance Do I Need?

Now that we know the ins and outs of term life insurance policies we can get down to numbers.

Answering the question of “How much life insurance do I need?” is not as easy as it sounds.

Nobody wants to leave their family buried under thousands of dollars in debt after their passing, but most consumers do not know what the appropriate life insurance policy amount should be.

The size of the policy you’ll need depends on your financial situation, your future, plans, and your wishes for your family.

The First Factor to Look at is What is Your Family Structure?

Do you have a spouse and children that rely on your salary? Does your spouse work or are your kids grown? Are you children about to go to college?

The more people that are dependent on your salary, the more life insurance coverage you’re going to need.

If your kids have moved out of the house and your spouse is working, then you can probably purchase a smaller life insurance policy.

If the kids are young, you have substantial debt, and a stay-at-home spouse, you may be looking at a million dollar life insurance policy or more.

Spend some time evaluating your finances. Factor in your mortgage, annual salary, investments, and yearly expenses. While a 1 million dollar policy sounds like plenty, you may actually need a policy with closer to 2 million dollars in coverage.

If you still have $125,000 left on your mortgage and an additional $15,000 in student loans, then a $250,000 life insurance policy might not be enough.

On the other hand, if your house is paid off, your kids are already out of college, and you only have a few credit cards or loans, a $250,000 policy could be sufficient.

Do not forget to calculate the cost of a funeral in the expenses.

While there is no “right” answer to the amount of life insurance policy you should buy, you should consider at least getting a policy that is 10x your annual salary.

Having a policy that is 10x your annual salary will give your loved ones the finances they need to pay off any debts and give them time to recover from the loss without having the added burden of funeral debt.

Your Current Lifestyle

The other factor to consider is your lifestyle and how you want your family to use the money.

Do you want your family to pay off debt and then invest the rest? Do you want them to be able to maintain the same lifestyle for the next ten years without having to worry about funds?

Each situation will require a different amount of life insurance policy.

Before deciding on a policy amount, talk to your family about your financial wishes for the insurance coverage and what makes the most sense.

I need information for life insurance and burial insurance for my elderly parents and for myself and my sister. My parents are in the late seventies. I am forty-nine years old and my sister is forty-seven years old and is disable.