If you’re self-employed or you’re a small business owner with no employees other than a spouse, a Solo 401(k) or individual 401(k) can help you save considerably more for retirement than you could with just an IRA.

This type of account comes with astronomical contribution limits ($69,000 in 2024) when you consider both the employee and the employer contribution, and you don’t need a traditional employer or “boss” to open this account on your behalf.

The Solo 401(k) works just like it sounds like it would. Once you decide on an online brokerage firm, you take the initiative to open this account yourself.

There are a lot of online brokerage firms to consider for your Solo 401(k), and you’ll want to compare all the top options before you open this account.

This guide can help you understand exactly how Solo 401(k)s work and how much you can save. We’ll also provide insights into the best online brokerage firms to consider for your retirement planning needs.

What Is a Solo 401(k)?

Table of Contents

- What Is a Solo 401(k)?

- How Much Can You Contribute to a Solo 401(k)?

- How Does a Solo 401(k) Work?

- Solo 401(k) Rules You Need to Know

- When Is the Deadline to Fund a Solo 401k?

- When Does It Make Sense to Open a Solo 401(k)?

- Where to Get Help Opening an Account

- The Bottom Line on Starting a Solo 401(k)

A solo 401(k) is a type of employer-sponsored retirement plan that is specifically designed for self-employed individuals or business owners without any full-time employees other than their spouses.

It allows these individuals to make contributions to the plan for themselves and their spouse, with the money growing tax-deferred until it is withdrawn in retirement.

Like a traditional 401(k) plan, a solo 401(k) plan has a high contribution limit and offers the potential for tax-deferred growth on investment.

However, unlike a traditional 401(k) plan, a solo 401(k) does not require an employer match, and the employer and employee contribution limits are combined into one limit.

How Much Can You Contribute to a Solo 401(k)?

In 2024, individuals with a Solo 401(k) can contribute a maximum amount on the employee end and the employer side of the equation.

As an employee, individuals can defer all their compensation up to the annual contribution limit of $23,000 for 2024. The only exception is individuals ages 50 and older can contribute up to $30,500 as an employee of their company.

The rest of the contribution Solo 401(k) participants can make is on the employer side. Here, you can contribute up to 25 percent of your compensation “as defined by the plan” up to an annual limit of $69,000 total or up to $76,500 if you’re 50 or older.

How does this actually work in practice? Consider this succinct example:

Solo 401(k) IRL Example

| Ashley, age 51, earned $50,000 in W-2 wages from her small business in 2023. She deferred $19,500 in regular elective deferrals plus $7,000 in catch-up contributions to the 401(k) plan. Ashley’s business contributed 25% of her compensation to the plan for the year, or $12,500. Total contributions to the plan for the 2024 tax season were $38,500. |

The above computation reflects the contributions the taxpayer can make if the business is established as a Subchapter S-corporation.

If operating as a sole proprietor, Ashley would be required to first deduct the $26,000 “employee” contributions, as well as half her self-employment tax from her net business income before calculating the 25% “employer” contribution.

This is why I strongly recommend using the services of a CPA when you have a Solo 401(k) plan or are contemplating establishing one.

NOTE:

The individual 401(k) lets you max that part out and contribute another 25 percent of your compensation on the employer side. The end result is the ability to save a ton for retirement and to reduce your taxable income in the process.

For reference, here’s how employee and employer contributions limits have changed for Solo 401(k) plans over the years for retirement savers under the age of 50.

| CONTRIBUTION YEAR | EMPLOYEE CONTRIBUTION LIMIT | TOTAL ANNUAL CONTRIBUTION LIMIT (EMPLOYEE + EMPLOYER) |

|---|---|---|

| 2024 | $23,000 | $69,000 |

| 2023 | $22,500 | $66,000 |

| 2022 | $20,500 | $61,000 |

| 2021 | $19,500 | $58,000 |

| 2020 | $19,500 | $57,000 |

| 2019 | $19,000 | $56,000 |

| 2018 | $18,500 | $55,000 |

| 2017 | $18,000 | $54,000 |

| 2016 | $18,000 | $53,000 |

| 2015 | $18,000 | $53,000 |

| 2014 | $17,500 | $52,000 |

| 2013 | $17,500 | $51,000 |

| 2012 | $17,000 | $50,000 |

| 2011 | $16,500 | $49,000 |

| 2010 | $16,500 | $49,000 |

How Does a Solo 401(k) Work?

As a reminder, a Solo 401(k) plan is nothing more than an individual retirement plan for self-employed people or small businesses without any employees.

Also, remember a Solo 401(k) is nothing more than a vessel you’ll use to save for retirement. You still have to choose the investments you’ll use within your account to build wealth.

As an employer, one of the main features of a Solo 401(k) is you’ll need to determine what your actual income is to determine your maximum employer contribution, which can be up to 25% of your compensation.

According to the IRS, your compensation is earned income, defined as..

“net earnings from self-employment after deducting one-half of your self-employment tax and contributions for yourself.”

But once again, this depends on the business structure of your company.

Solo 401(k) participants can open their account with any brokerage firm they want, although online providers have become extremely popular due to the fact you can get started at home and on your own time, and often with access to an array of helpful investing tools and resources.

Online brokerage firms also tend to come with low costs overall, which is another reason investors seek them out.

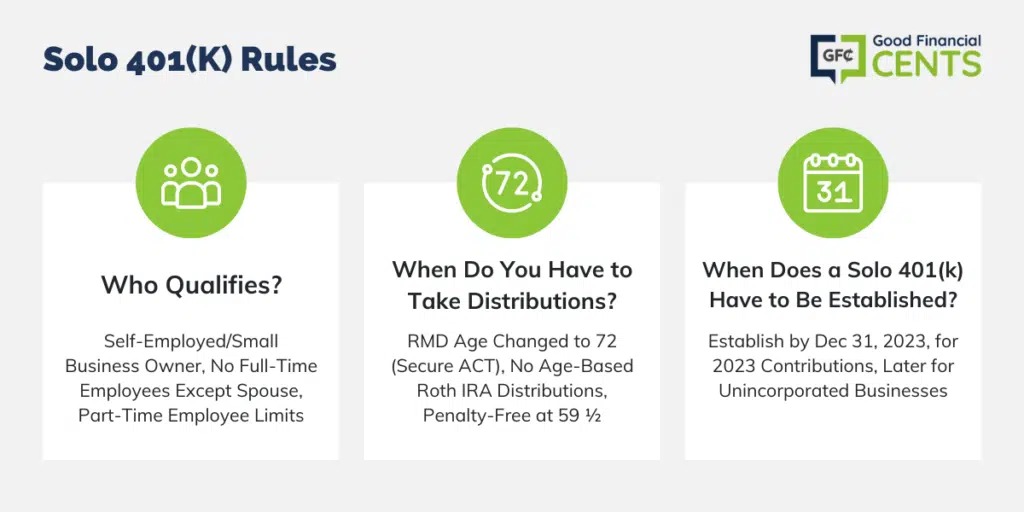

Solo 401(k) Rules You Need to Know

As you move closer to opening a Solo 401(k), there are some more details and rules you should know and understand. Here are some of the main Solo 401(k) rules that can help you figure out if this is the right plan for you.

Who Qualifies?

To qualify for a Solo 401(k) plan, you need to be self-employed or own your own small business. You cannot have any full-time employees except for a spouse.

You can have a part-time employee and still have this plan, provided your part-time worker puts in less than 1,000 hours per year or less than 20 hours per week.

When Do You Have to Take Distributions?

Where you were required to take Required Minimum Distributions (RMDs) at age 70 ½ until 2024, the recent passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act bumped that figure up to age 73.

In short, this means you’re required to begin taking distributions once you reach that age. This is unlike the Roth IRA, which doesn’t require distributions at any age.

Note you can take distributions without a penalty any time after you reach the age 59 ½.

When Does a Solo 401(k) Have to Be Established?

To make a contribution to a Solo 401(k) for 2024, you are required to establish your account before the end of the year or by December 31, 2024.

It’s possible to make contributions to a Solo 401(k) after the new year (and before your tax filing deadline, which is normally April 15), provided your business isn’t incorporated.

When Is the Deadline to Fund a Solo 401k?

The deadline to fund a solo 401(k), also known as an individual 401(k) or self-employed 401(k), for a given tax year is the tax-filing deadline for that year, which is typically April 15th of the following year.

However, if an extension is filed, the contribution deadline can be extended to October 15 of the following year.

It’s also worth noting contributions to a solo 401(k) can be made up until the employer’s tax-filing deadline, including extensions, even if the employee’s tax-filing deadline has passed.

This means contributions for a given year can be made as late as October 15th of the following year, which is the deadline for filing an extension.

The $250,000 Rule

You should also be aware of one more rule. Once your Solo 401(k) plan grows to over $250,000 in assets, you’re required to file an Annual Form 5500 EZ. You’re also required to file this form if you close your account.

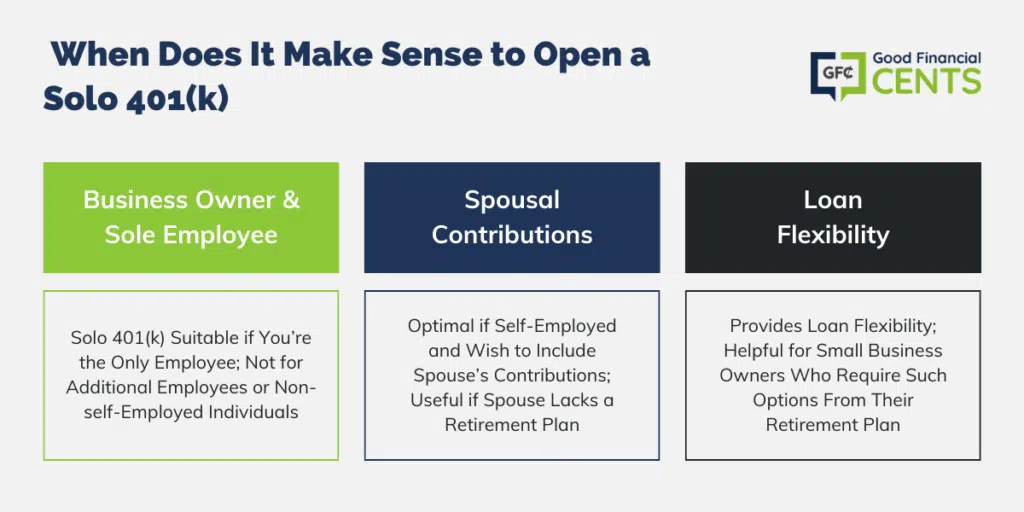

When Does It Make Sense to Open a Solo 401(k)?

A Solo 401(k) isn’t the right investment strategy for everyone. Here are some scenarios when opening a Solo 401(k) makes sense:

- You’re a Business Owner and the Only Employee of Your Company: This might seem like a given since this is the exact person Solo 401(k)s are for, but it’s worth mentioning it’s also the only person Solo 401(k)s are for — if you’re not self-employed or if you have additional employees it won’t work to open a 401(k).

- You’re Self-Employed and Want a Retirement Plan Your Spouse Can Contribute To: Since you can add contributions from your spouse to a Solo 401(k), opening one could be a strong strategy if your spouse currently doesn’t have a retirement plan or if they haven’t maxed out other retirement contributions.

- You Want the Ability to Take Loans From the Plan: While taking a loan from your own retirement plan isn’t ideal, the realities of being a small business owner could mean you want or need that flexibility.

Where to Get Help Opening an Account

You can open a Solo 401(k) with any brokerage firm that supports this type of account — most do. However, some online brokerage accounts do offer more perks and benefits than others, which could make them ideal.

What Is a Brokerage Firm?

A brokerage firm is a company that helps buyers and sellers complete financial transactions.

They earn money based on fees or, in some cases, commissions involved with the transaction. In many cases, special licensing is required to buy and sell financial products, which is where brokers are necessary and helpful.

You might also find individual brokers who work independently, but typically, brokers are connected to a larger team (their firm) that can collaborate to help with transactions.

How Can Brokers Help?

When it comes to setting up a Solo 401(k), a broker can help you set up a plan and process stock trades. Even if you want to direct your own Solo 401(k), you will still need a broker with the appropriate credentials to set up your plan and complete your trades.

What to Expect When Working With a Broker?

Not all brokerage firms are created equal. You can find some that take a hands-on approach to managing your finances and others that will step back and allow you to do it yourself (if that is your preference).

You should expect that all brokers will charge a fee or commission. Some brokers might provide additional tools or resources, such as a mobile app or financial educational trading, that could make them a preferable option.

We compared some of the top providers to help you narrow down your list of potential options. There are lots of excellent brokerage firms out there with various pros and cons,

The Bottom Line on Starting a Solo 401(k)

Opening a Solo 401(k) comes with a ton of important benefits, the most important of which is your ability to save more money for retirement than you would otherwise.

Since contributions to a Solo 401(k) are tax-advantaged, you can also invest more to reduce your taxable income now, although you will pay income taxes on Solo (k) distributions once you begin taking them in retirement.

If you’re self-employed, you should absolutely consider opening a Solo 401(k), but you can also consider the SEP IRA, which works differently but comes with an annual limit of $69,000 for 2024.

Either way, make sure you compare all the top online brokerage firms to see which ones offer the internal investments you want with plenty of investing tools and resources.

Also, make sure to compare fees so you know how much you’ll pay for account administration and any trades you make throughout the year.

What’s Going down i’m new to this, I stumbled upon this I have discovered It positively useful and it has helped

me out loads. I hope to give a contribution & assist different

customers like its helped me. Good job.

Hi Jeff – Question:

When the owner closes their business that is tied to their solo 401K and opens a new business in a different state – is it possible to change/move/update the existing solo 401K to the new entity? If not (which I think may be the case), and a new account with a new Trust EIN for the new company is required, what becomes of any loans against the previous solo 401K? Can the previous loan be assumed by the new solo 401k? Or is the unpaid amount considered a distribution?

Thanks – Gina

This is great information. Perhaps I missed this answer, but I have a lingering question: Does the money I put into my Solo 401(k) have to come from my business revenue or does it not matter? In other words, can I automatically contribute via the contracting company I work for since they don’t have a 401(k)? I am not an independent contractor in this scenario.

I/we contributed to our IRA for 10 years the actt. was dormant for 14 years.

Finding the document as of 2004 showing a nice balance I found that BANK ONE HAD BEEN ABSORB INTO CASE BANK .

After many phone many phone calls found informaion that my account had been completely depleted.

Seems that IRAs are not protected by bank lns.

Some one was able to withdraw all my funds.

This seems so unfair, and is a criminal act..

Seems that I have to prove that I never took any

Withdrawals

Having never received any statements from CHASE yet they have my present address on file.

Something is really wrong here.

Hi Dean – You may want to talk to an attorney.

Thank you for a very informative article Jeff.

I have a question rather than a comment if I may?

I understand the employee portion of contributions to a solo 401k are subject to FICA taxes, but am wondering if my employer portion of contributions would be excluded from FICA, as in the case of a traditional 401k? Sorry if it was explained in your article and I misunderstood. It’s hard to put aside this much as a self employed person if you have to pay the FICA on both sides.

Hi Brenda – I’m not an accountant so I don’t know the specific answer to your question. But since a solo 401(k) is simply a 401(k) plan for one person, my guess is the rules are the same as for an employer plan. In that case, the employer match can be deducted from income before calculating the FICA tax. But that’s just an educated guess, you might want to check with an accountant.

There is no such thing as a “solo 401k” plan. A 401k plan is just a 401k plan. The rules for how to run it change depending on whether or not there are common law employees, but you should not have to “switch” from a solo 401k plan to a “traditional” 401k plan. They are all the same (assuming you haven’t bought into some weird legal document that is calling itself a “solo” plan and therefore contains legal restrictions that shouldn’t be there). See my article: What is a Solo 401k Plan at http://www.consultrms.com/Resources/55/Solo-401(k)/126/What-is-a-Solo-401(k)-Plan. As well as IRS website: https://www.irs.gov/retirement-plans/one-participant-401k-plans

Hi Annemarie – That’s somewhat true, except that the IRS does have a dedicated website for the solo 401(k), and the convention is to consider it as it’s own thing. It’s basically a 401(k) for one person (plus that person’s spouse), but it’s not entirely unique.

In order to qualify for a Solo 401k, do you need to have an Inc. or any other entity?

Or is it also possible, to just have an LLC?

Or even no type of company at all – just working as a Freelancer with your name and personal liability?

Another thing I wonder about the Solo 401k:

If you are self-employed you don’t have the opportunity to get an employer to match your contributions. That’s what I would see as the real “free” money and the true benefit of a 401k plan.

In the end, starting a Solo 401k … well, it’s all your money that’s going to be invested.

So what’s the real benefit of starting a Solo 401k then?

Thank you so much for any little help, appreciate it.

Hi Ben – You don’t need any type of business format, you can just file a Sch C or be a freelancer. You’re right, the “employer match” comes from you, but then it allows you to take a bigger tax deduction. The benefit is that you can contribute more to a solo 401k than you can for most other plans on less income.

What kind of rate of return (interest) do I make with the Solo 401(k)?

Hi Christopher – A Solo 401k is a self-directed investment account. The return is entirely dependent on what you invest the account in.

Hi, I created my solo 401k account and am interested in investing in real estate. My question is whether I can invest in a property with another investor that is not part of my solo 401k?

Thank you for your time.

Hi Sandra – I don’t know about direct investing in real estate through a solo 401k, but it is permitted with IRAs – IN THEORY! In practice, there are about a dozen violations that can get your plan killed. One of the big issues is that as holder of the plan you can’t participate directly in real estate investing. Talk to a CPA about this, it’s a true gray zone.

I just stumbled unto thi ssite searching for Solo 401k information.

I have a 401k from a previous employer while I was employed there and the account is sitting idle, yet still earning about 16% for 2017 (not bad). I am self employed now (same industry) and was thinking about rolling the 401k into a Solo 401k so I can make alternative investments.

My question is: must I may myself as a W2 employee in order to contribute into the Solo 401k account, or do I simply just cut checks into the Solo 401k account until I max it? I have an S Corp, so all Net Income flows to my 1040.

I wanted to have a checkbook controlled Solo 401K. Is this a different way of opening the account, or are ALL Solo 401k accounts checkbook driven?

My plan is to LEND, as a private lender, funds from my Solo 401k. I may charge “points” on top of my requested interest rate. Is ALL income derived through the investment transaction considered earnings for the Solo 401K account, or only the interest rate on the note? For example, would be points charged for the loan also be considered earnings for the account, or that disallowed?

Thank you so much for in advance for your comments.

Hi Joe – You should be able to set up a solo 401k for you S corp. But I don’t think you can make private loans to individuals out of the account. Please consult with a tax attorney on this point, it’s not something I’ve ever heard of.

Is there a way me to put money into a SEP IRA or Solo 401k with my newly-opened single member LLC Blogging business? Right now it doesn’t have any profit and will probably not have any for the first 2 years, based on what I’ve read on other blogs.

A primary reason for opening my business was to boost my retirement savings. I’m a W-2 contractor who makes too much to contribute to T-IRA or R-IRA, and my employer does not have a good retirement plan.

It’s starting look like creating an LLC will not boost my retirement saving for a few years until it become profitable.

Thoughts?

Hi Major – You can’t do it on your blogging business until you have income from it. But you might be able to do a solo 401k on your contractor income. But I believe your employer will have to switch you over to a 1099 for you do to do that.

I have 100% ownership of an IT Consulting s-corp with only myself and my wife as W2 employees. I have a Solo 401k setup currently but I have only made contributions for myself.

Wife has her own beauty business, s-corp, 100% ownership, part-time employees who may become full time eventually. No 401k setup.

1. Are we both eligible to make Solo 401k contributions under my company?

2. Is she still qualified to make Solo 401k contributions under my company if she has full-time employees in her company?

3. If she takes on a partner in her company, would she still be eligible for my company to make Solo 401k contributions for her?

Hi Brian – My understanding is that she must be an employee of your company, and earn wages to be eligible. The fact that she has another business isn’t a factor, unless she has a plan there and is at risk of exceeding the cumulative maximum to all plans of $55,000. Check with your CPA to be sure.

If the wife has to be a wage earner, can she be 1099d by the husband or does she have to be W2?

I think the 1099 would work. She has to actively participate in the business. But check with your tax advisor before making any contributions. The 1099 route may open up other requirements.

Remember: In addition to Solo 401K you can also contribute to a traditional IRA for you and your spouse whether she works or not. For 2018 that comes to a deferral of $74,000.

I wish that were true Charles! The maximum contribution to all plans is $55,000 for 2018, or $61,000 if you’re 50 or older. You can have both plans, but the amounts contributed will have to fit neatly within the overall maximum for all plans. Like $5,500 into the IRA, and $49,500 into the Solo 401k, if you qualify to contribute that much to the plan.

I have taken your advice and set up a Solo 401K (through E*TRADE) for myself, an independent contractor. As the plan year-end approaches, I want to “elect” to make the 401K contribution. How is the election made? Is there a form? How should this paperwork be saved?

Thanks!

Rob

Hi Robert – You can check with E*TRADE, they’ll have a specific process for that, including the forms. Also, what do your plan documents proscribe for the contribution process.

So glad I found this site and string of messages. I have a single owner S Corporation. My accountant is pushing me to setup a 401K for the business. I have no employees and no intentions of hiring any in the future. I also do not plan on contributing more than $5,000-10,000 year. I am pulling about $85,000 in salary and the corporation has about $150,000 worth of profit.

I raised the question of a SEP IRA and again was pushed towards the 401K, which brings with it a $4,000 setup fee as well as an annual fee of about $1200. All run through the investment contact he provided.

For many years I have been contributing to a SEP IRA but now that I started this single owner S Corp, I am aware that I am no longer able to personally self-contribute to my SEP-IRA since I am now an employee of the S-Corp. That said, I thought that the S-Corp is allowed to make contributions to my own SEP-IRA, up to 25% of my W-2 income. Instead of me personally receiving the tax deduction for the contribution, the corporation would receive the tax deduction (which would still benefit me).

Am I missing something? I do see the benefit for offering a 401k to potential future employees, as well as being able to potentially increase my own contributions in the future (if I wanted to go above the 25% limit of my W-2 income) but as of now, I have no plans to do either of these things.

What other benefit would there be to setting up the 401k at this point in time? I don’t want to leave a great opportunity on the table by only utilizing the SEP if there are other advantages that I am not understanding.

Thanks so much for your help!

Hi Paul – For most businesses, a solo 401(k) will allow for larger contributions than SEP IRA, but not in all cases. I also don’t see why you have to abandon the SEP IRA due to the S Corp status. However, there are some quirks with the SEP IRA when it comes to S Corps, and that may be what your accountant is referring to (he’s probably right). But you might want to see if you can find a plan that will be less expensive.

Paul, your accountant should be able to steer you to a Solo 401k plan with NO setup fees and NO annual fees, such as e*trade. There is no need to pay an investment company those inflated fees for a Solo 401k account.

Hey Jeff – I’m curious how / where you set up your solo 401k that allowed you to invest in non-traditional things like Lending Club (I assume this would also include crowdfunded real estate like Fundrise)? What are the administrative costs / headaches that come with that? Thanks!

@Jake I set it up with a local company that specializes in 401k plans. It’s definitely more expensive than a SEP IRA with the 5500 preparation and the fact I now have employees.

There are no headaches since they take care of it. Cost wise it’s about $1k per year.

Situation: Husband and wife both have W2 paying jobs, husband also is an independent contractor, hired on an as needed basis for the same services, at two different unrelated locations, paid directly via 1099. He does not work with any partners or have employees. Husband wants to setup solo 401k, and already contributes the maximum 18k to his w2 Jobs traditional 401k. He would like to put the maximum possible into the solo 401k, as close to the $54,000 limit.

1) Assuming he now can only make employeR contributions since he already reached 18k at his W2, up to 54k/100% earnings limit directly as an individual or does he have to form an LLC to make a profit sharing plan work?

(Or in another way, how does IRS know whats employee and employer contribution? If I work for myself as contractor, can I just fund my solo-401k up to the limit 54,000 throughout the year or do I need a different entity to be the “employer” to make that contribution? tryna figure out exactly what to do before I open an account)

2) if the gross amount earned from both job sites in the 1099 totals $100000, would the amount he can place as employer contribution be 20% of that or 25% of that?

Hi Peter – The solo 401k is pretty flexible so you don’t have to form an LLC to be the “employer” in the arrangement. You can be the employer even with a Schedule C. The employer portion will be based on the business profits.

The contribution will work out to be 20% effectively, since the IRS requires you to reduce your income by the amount of the contribution before calculating the contribution. That works out to be 20%. If you’re doing this for the first time, set it up with an accountant so you get the numbers right. The IRS has all kinds of tricky calculations you must follow.

“For both the SEP IRA and Solo 401k you would be able to make a $21,175 employer contribution (25% X $84,700, which is Net Earnings after self-employment tax is deducted).”

Incorrect for sole-proprietor owner!

The max profit sharing rate is 25% BUT it is ADJUSTED to the owner so using the max rate of 25%, it’s really 20% (formula is provided at IRS website in its publications) and has NOT changed for Years!

The Solo 401k is Better than the SEP IRA because of the 401k feature and that the profit sharing feature is Already Part of the Solo 401k.

The only other difference is that there is a possible fee involved because of the 401k plan section of a Solo 401k whereas there’s no such fee for the SEP IRA.

You’re correct, and I am aware of that calculation. We’ve included that factoid in some other retirement posts, but since this was one of the first, we left it out. We’re trying to do an overview without going so deep as to confuse.

The IRS has a convoluted calculation where you must first reduce your income by the amount of your contribution before calculating your contribution, which is something that usually only accountants understand. The net result is that the actual contribution is 20%, not 25%. (20% works out mathematically to be 25%, less the 20% contribution.)

Trust me, it wasn’t an oversight, but rather an attempt to avoid paralysis by mathematics. As I said, we’ve included that in other posts, but I’m not sure many readers can follow it. It’s sometimes best to present the basics then leave the number crunching to the accountants.

Husband and wife with an LLC recognized as a Sub S for taxes. If I make $18K and my husband makes $5k in the Sub S, both over 50, no other employees, how do I fill out a W2? Since the entire amount can go into our solo 401Ks is box 1 0 and box 3 and 5 the corresponding wages, $18 and $18K (and $5k and $5K) and then 12d indicates profit sharing? When do I need to pay then the SS and Medicare on the 940 and state? Each quarter or at end of year?

Thank you.

Hi Lou – That’s a payroll tax question, so I think you need to get input from an accountant. This is REALLY important since the penalties for filing errors on employer payroll taxes can get ugly. Please get help with this.

Hi Jeff,

Regarding Solo401k, I am Realtor in CA, simultaneously I work as a consultant in IT earning W2. Can I open Solo401k as Realtor and move my previous employer 401k funds/IRA funds to new Solo40k opened. Also can my spouse (just helping me on real estate research and not working anywhere) contribute her previous 401k/IRA funds in to the same solo 401k funds that I open as trust. If so Can we both together invest in real estate transactions like buying together fixer uppers and fix and sell and contribute back all profits back to the same solo401k tax free?. Please suggest.

Thanks

Hi DK – You’ve got a lot going on there so I’d definitely consult with a CPA before doing anything. But I think you can set up the solo 401k for your realtor business, and then move your current retirement balances there. Your spouse could do the same if also participating in the plan through the real estate business. You can contribute what ever the legal limit is based on your real estate income. But as I said, consult with a CPA for all that you’re trying to do.

Excellent article on the benefits of the solo 401k. I am a conservative saver, and have had an IRA since I was 16, but had no idea this option was open to me! My question is WAGES vs COMPENSATION. Assume an S-corp earns $136,000 a year, and pays $36,000 in W-2 wages to the owner and sole employee, with the remaining $100,000 in distributions (not subject to payroll taxes). What are the contribution limits?

A) Flat $18,000 employee contribution and B) the employer contribution is 25% of what? $36,000 (WAGES) or $136,000 (TOTAL COMPENSATION)?

Also to me the huge advantage of going this route is that the $18,000 can be a fully tax-free ROTH account! Would be nice to emphasize that in the article. Even if one doesn’t take the employer contribution, the ability to sock away $18,000 in a Roth account is amazing!

Hi Pat – The contributions would be based off of your $36,000 in W-2 wages. That includes both the $18,000 employee contribution and the 25% employer contribution. The $100,000 distribution is considered to be a dividend, and therefore unearned income. Under IRS regulations, it doesn’t qualify to base contributions on. But this provision is unique to S corporations.

I don’t believe that you’re right about $18,000 going entirely to a Roth account. I believe that the maximum for the Roth is $5,500, with the rest of the contribution going into your regular account.

Hi,

I am the sole owner of an LLC and just starting out with saving for my retirement. I am 34 years old and earn on average about 70-80k a year from my business. I am thinking of starting a Roth IRA & a Solo 401k account. My question is, who or rather which investment firms are most trusted and respected in the industry to establish these accounts with? Thank you, Katie

Hi Katie – There’s no simple answer to that question! It really depends on what you’re looking for. For example, are you looking for a fully managed investment account, or do-it-yourself? You might call around to the various investment brokers and see if what they have to offer will work for you.

Fidelity has the best no fee simple 401k plan (no loan option and no Roth 401k option). Fidelity funds have no transaction fees and some funds have very low expense rations (FUSEX/FUSVX). Etrade has a more robust option with no upfront fees and a loan and Roth 401k option, but you will be paying more transaction fees as you will be paying fees for mutual fund transactions. Capital one solo 401k (called Spark 401k) charges an asset management fee and other fees which total under 1% a year but this is still a lot, and can be a considerable drag. But they do all the investments for you.

Check out the blog white coat investor, solo 401k for more info. I chose Fidelity. Choose what’s right for you.

Good Luck.

Let’s say you have a one person S-corp that has a good year 1 and makes $200K net profit. They pay out $60K in salary, $40K in distributions and the company keeps $100K of this money in the corporate bank account as retained earnings. (They pay various taxes on the full $200K of course.)

In year two, the company only makes $10K net profits, but there is enough in the corporate bank account to still pay the sole employee a salary of $60K.

My question is: In year two, could the employee with $60K in W2 income still make an $18K Solo 401K contribution with a $15K company match? (This would be paid from the retained earnings the year before.)

The reason I’m confused is you can only make contributions from Net Income. In year two, the company didn’t make enough in Net Income to cover the salary, let alone the matching. But the employee would have W2 income…

Hi MM – That’s an excellent theory question to ask your CPA! I’m not a CPA, but I’m going to guess that it will be based on your net personal income from the S corp, which you of course are the owner of. You MAY be able to make the full employee contribution, but then again you might also have to net out the business loss (which will flow to your 1040 by a K-1 from the S Corp) from your salary. That’s why you need to ask your CPA about this. The IRS regs give an overview but they don’t address specific situations such as yours.

Hi – great questions and comments. I’ve learned a lot.

My husband has 1099 income for a sole proprietorship. We file joint taxes. We both have other jobs with 401k, or in my case a pension annuity. We opened a solo 401k last year to move an ira I received through a divorce in order to do other types of investments, mainly promissory notes).. I do not now, and do not plan on making contributions to this account other than dividends from payments. Do I need to be on a w2 payroll? My assumption from reading through comments is that I do not need to be, but I want to be sure I am in compliance.

Hi Fran – Since you don’t plan to make ongoing contributions you shouldn’t need to be on the payroll. But I think you will need some other “connection” to the business to roll the money into the plan. Please consult with an accountant to make sure you get this right.

Jeff, thanks for the great info and advice. I took it and created an individual 401(k) account in 2016. I own a sole proprietorship business and in addition to my contributions to my traditional IRA, I’d like to make a 2016 pre-tax contribution to my individual 401(k). Where do I report this on my tax forms so that I get a deduction?

Hi Doug – You should be able to report the contribution on Line 28 of your 1040 page 1, “Self-employed SEP, SIMPLE, and qualified plans”. If you use a tax software package it should go there automatically.

I did a calculation for a 62 year old sole proprietor with no employes earning 65,278. The Solo IRA came out to be 36,133. Can I deduct that whole amount in the 1040 Line 28?

Hi Ernie – It may be right, but I’d check it with an accountant first. It’s a big deduction and it will draw IRS attention. They do have some weird algorithm to calculate it, so it’s best to be absolutely certain before filing.

I made an investment (business loan) with an LLC operated by my sons to buy condos. Is there a way this can be considered income for the purpose of using a Solo 401K?

I am currently not working for anyone else, so no 401k option.

Thanks, great information!

Hi Darin – The rules as to what constitutes self-employment income for a solo 401k are pretty liberal. Since it was a business venture, the profit you earned could be considered business income. I’d discuss the best way to handle this with a CPA, since it largely depends on personal circumstances and the tax presentation.

er 50.

I am contributing $24,000 under 403b. I am contributing $24,000 under 457.

If I have Schedule C income (separate job) of $80,000, given the above, how much can I contribute to a solo 401k?

And can I still make a non-deductible Traditional IRA contribution of $6,500?

Thanks in advance.

Hi Vernon – You’re limited to a maximum of $54,000 total from all plans, so you may not be able to make the full IRA contribution. Discuss this with your CPA.

What happens to the Solo401K when you stop being self employed, i.e., retire.

Can you keep it open (like an employer 401K) or does it have to be rolled over to something else like an IRA?

Hi Ron – You should be able to continue to keep the 401k open even after you retire. You’re the owner of the plan. Now if you liquidate the company, you may also need to distribute the 401k proceeds. You may want to talk to a CPA if that’s the case.

Hello,

I have an LLC for which I am the sole proprietor and I am thinking about opening a Solo 401k. I am also starting another LLC with a friend (not a spouse) this year. We are both owners. Can I can open the 401K under my new business with my partner (would be beneficial as the second business will bring in more income thus allowing for maximum contributions/yr) or do I have to be the solo owner of the business?

Hi Tivere – You should be able to under the original LLC for which you are a sole owner. As to the second business, I believe that it is ineligible for a Solo 401k since there are two of you. But you can open a regular 401k for that business. But either way, your contributions will still be limited to $54,000 per year ($60,000 if you’re over age 50) in all plans in total.

Hi, Thanks for a great article! I’ve been doing lots of “research” (Google) on this subject. According to this website https://www.401kcheckbook.com/checkbook-control/checkbook-control-401k/ having partners does not disqualify you from having a Solo 401k. Any updates on this?

Hi S – That’s correct. You can qualify for a Solo 401(k) based on income from a partnership. But as far as I know, you can’t do it if the partnership sponsors the plan. It has to be your income individually.

Thanks for this thorough article and question replies Jeff.

I am setting up an LLC (taxed as a partnership) and have two questions about setting up a solo401k in the future.

The members of the LLC will be me and a C-corp I control, and perhaps also my wife. Does anything about the ownership structure affect the use of a solo401k that both my wife and I could make contributions to?

At present I don’t plan for either of us to have a W2 salary from the business. Do you have to have W2 income to make solo401k contributions or can you do so based on net profit distributions to each partner? If she were not an LLC member/partner is there still a way for her to make contributions to a solo401k? [ok, i guess that makes it three questions…]

Hi Jeff – The set up with the C corp is a complication, and I recommend you consult with a CPA about it. The IRS MAY view the corp as a “third person”. If so, you can probably just set up a regular 401k instead. But that’s why you need to speak with a CPA.

Hi Jeff,

Thank you for great article. I have a scenario for you – I have a LLC business opened back in 2012 and until 01/2017 I was employed.

Employer had a 401k plan.

Now in 2017 my business is my 100% income /contracts 1099/. We were thinking to put my wife and me on payroll. Can my wife and I open solo 401k and contribute /deducting from payroll/? Is the payroll good idea?

Not planning to have more employees just two of us.

Thank you

Hi Peter – You should be OK with the solo 401k if it’s just you and your wife. Payroll is the easier way to contribute. You can use it to contribute up to $18k per year, or $24k if you’re 50 or older.

Hi Jeff,

If my salary is $18,000 and I am contributing entire $18,000 as an employee to solo 401K.

Do I still have to pay employ portion of FICA taxes on $18,000? If so do I add15% of FICA tax ~$2700 to $18,000 and make paycheck $20,700?

You must still pay the FICA taxes. The contribution defers the regular income tax, but not the FICA portion. As to the amount of the contribution, the IRS has a matrix-like calculation provided on its website that you’ll have to see to believe.

Question: I am an independent contractor, first year in business, so I have not paid any taxes yet on my earnings yet. I will end the 2016 year making $14,000,. If I set up a solo 401k before 2017, could I put in the whole $14,000 and avoid taxes on it? I have a home office and internet/cell phone deductions I was planning to take on the business, but should I just put in the entire $14,000, or take the deductions and put in the leftover amount? I was under the impression that I had to pay social security and medicare payroll taxes no matter what, is that not true with a solo 401k?

Thanks!

Hi Shelly – If you declare the entire $14k as income to put into the 401k, you’ll still need to show the entire amount as self-employment earnings subject to Social Security, so it will work out. But you may want to declare those expenses to reduce the Social Security tax, which is 15.3%. Also, make sure you have the money to pay the tax, which should be in the neighborhood of $2,000, depending on how large the expense deductions are.

The 401k deduction will eliminate your federal and state income tax, but you’ll still owe the Social Security tax.

Hello Jeff. I made $37,300 this year (2016)

How much I can contribute as an employee for Solo 401 K?

How much can I contribute as an employer based on $37,300 annual salary?

What happens if I do not want to make the employee contribution but will only contribute the employer portion. Is this allowed?

Thanks a lot

AZ

Hi AZ – Assuming you’re under 50, you can contribute $18,000 as an employee, plus 25% of your salary (assuming that’s your entire business income), which is an additional $9,325. That’s a total of $27,325, or almost 75% of your income. I believe you can take the employer portion without doing the employee portion, but please check with your tax preparer.

Hi Jeff,

I know this is an old post of yours but I saw a couple of recent questions you answered so I thought I’d try. 🙂

Having read so many articles, including the ones on irs.gov, I’m still not clear on the limit on the employee deferrals.

Is it the lesser of $18,000 and the business income for the year? (I’m a full-time employee with a side business that gives me only around $10K a year).

If that’s the case, what is considered the “business income”? You mentioned “pre-tax” income. You’re referring to the “gross income”, correct? Whatever shows up on the 1099s that I get from companies I contract with. Period. Prior to any deductions or taxes. Correct?

So in my case, if I had gross receipts of $10K for the year, I can only contribute up to $10K (assuming my 401K contributions in my full time employment is $8K or less). Correct?

Thanks much for the clarification,

Rao

Hi Rao – Actually it’s your net income. That’s the $10,000, less any expenses you write off on your Schedule C. As an employee, you can take 100% of the net amount. You won’t be able to add an additional 25% of your net profit, because your contributions to a solo 401k cannot exceed your net income from the business. Does that make sense?

It does. Thanks much!

Ok, so in this case even if we are just a sole proprietor, we can’t use money from our full-time employment to contribute to the Solo 401k? We are limited to what we report on the Schedule C? What if the income is from rental real estate (Schedule E) that we actively manage?

Hi Ben – Nope, nothing from full-time employment. But yes on Sch C and Sch E income. Please discuss all such strategies with your tax preparer to get the opinion of someone who knows your specific financial and tax situations.

I was employed for half of the year and made contributions to a traditional 401k plan through my employer. The second part of the year I was an independent consultant/sub-contractor. I was paid directly for services. Are their contribution limits from my traditional 401k plan through my employer combined if I want to start a solo 401k or SEP IRA?

Hi Rocco – The ultimate limit on all retirement contributions for 2016 is $53,000. So you can make solo 401k contributions so long as those contributions, plus the employer 401k contributions (including employer match) don’t exceed $53,000. For 2017, the entire amount can go into your solo 401k, as long as you no longer have an employer plan.

My wife and I each have the 401K solo plans for our business. We are over 60 so will take the maximum deferral and catch-up to total $24,000 each.

I understand the employer contribution is limited to 25% of total compensation. Does that mean 25% of our individual compensations, or of the TOTAL of both of our compensations. She now gets $90,000, I get $200,000.

If needed, I can adjust each of us to $145,000 (same $290,000 total for both) so we could both hit the maximum of $35,000 for the employer contribution or can we still do $35,000 each with the current salary split?

Hi Tom – Retirement plans are always tied to the individual, even when married filing jointly. The compensation would be what each of you earns individually.

I have a question about tax deductions

Situation A: My employer has a 401k w/ match and I have maxed out contributions to that this year.

Situation B: One of my business entities (single member LLC, pass through tax) earned a profit and I want to contribute 20% of those profits to its solo 401k

Is Situation B’s contributions a tax deduction? I wasn’t sure if salary deferrals and profit contributions were different in this regard.

Hi Eric – I’m not certain how it flows on your tax return specifically, but the end result is that either reduces your taxable income. I hope this answers your question.

Jeff, I am the active partner in a three person LLC. I have now begun doing some consulting on the side and want to start a separate C-corp. Can I now convert my guaranteed payments into consulting fees paid to my c corp? Will this allow me to open a 401K and maximize my pre tax contributions?

Hi Steve – You’re stepping into a gray zone there. I’d strongly recommend discussing the ins and outs of that strategy with your CPA. He/she may recommend against it, or support the idea with proper flow and documentation.

Hi Steve, I’m curious about your question as well, did you get an answer from your tax lawyer or accountant? Thanks, jacobkeltner at gmail dot com

I am a sole proprietor who has an established SOLO 401K from 2015. I hired employees in April of 2016 so I realize there will challenges contributing to this moving forward. Can I contribute a proportional amount (say 1/4 of the max)to the SOLO 401K for the time where I did not have employees (Q1 – Jan-Mar 2016)?

Hi Andrew – This is a point I’m not clear on myself. But I believe that since you now have employees, your solo 401k must become a regular multi-employee plan for the year. But please check with a CPA.

I am over 50. My wife and I own a LLC passing all profit through a personal 1040. The profits are over 100K per year. Can I just contribute $100 per year to a solo 401, avoiding FICA taxes, and the LLC contribute the remaining up to the max of $59K? Are FICA taxes due on the employer side of the contributions to the solo 401K?

Thank you.

Hi Mike – It sounds like you’re handling the income from the LLC as a sole proprietorship. The income will have to be subject to FICA tax in order to be eligible to contribute to the solo 401k. If it isn’t, it’s considered a dividend, and not eligible for contributions.

Do you have to show FICA earnings or is Self-Employed Contributions Act (SECA) eligible as well?

Hi Armin – They’re actually the same thing. The SECA just defines what income is subject to FICA, which is the self-employment tax for business owners.

I recently sold my business with a profit. I am currently operating another small business, which does not make a profit at this time. The business that I sold was actually sold as Installment Sale of Income. Therefore I have not filed a Schedule C on that business for 4 years. Can I invest some of the $ from the sale of the profitable business into a SOLO 401(k), or not beings I have no income from it on a schedule C?

Hi Laurie – The income from the installment sale is not considered to be earned income, so you can’t make retirement contributions from it. You will only be able to fund any retirement plan with actual self-employment income. Sorry the answer probably isn’t what you were hoping for!

I am a 1099 contractor. Is it possible to have both a i401(k) and a SEP-IRA?

I assume you cannot ‘double dip’ your employer contributions, but if i contribute the max 20% of net profits to my SEP IRA, can I then max out $18k as my employee contribution to my i401(k)?

Hi Dustin – That’s possible, as long as you don’t exceed the total contribution limit for all retirement plans, which is currently $53,000, or $59,000 if you’re 50 or older. I believe you can do what you’re describing, as long as you don’t exceed the $18,000 employee contribution. But please consult with a CPA before undertaking that kind of strategy.

Business A has a net after self-employed taxes of $200k and is owned and operated equally by my wife and me, and we have no employees for this business. Business B (completely different world) provides $500k net ($250k to each of us) of which we are each 25% owners has 100+ employees. Can we both put $59k (total $118k and we are both over 50) into a Self 401k completely through Business A?

Hi Steve – In theory, you should be able to fund a solo 401k from business A, but not business B. But also keep in mind that any retirement plan you have through business B will reduce your contribution to the solo 401k. Also, I’m not sure about your numbers, so I’d recommend that you discuss this with a CPA. (You wrote “net after self-employed taxes of $200k”, and I’m not sure what that means.)

Thanks for this article. I am a sole proprietor and will be forming an S-Corp soon, to become active starting in January 2017 to keep taxes a bit more simple for this year. 🙂 However, I’d like to start a Solo 401(k) as soon as possible, and I’m unclear on whether I can open one now or if I should wait and do it once the S-Corp is formed. Does it make any difference? Will it be under my name no matter what, rather than my business’s name?

It shouldn’t be a problem if you set it up now. It’s based on self-employment income, whether that’s as a Schedule C or an S Corp. You may have to set up a new plan though since the S Corp is a new entity.

The solo 401k seems like a good investment tool. I am sole owner of a C corporation, where my wife and I are the only vested employees. Could we set up a JOINT 401k for both me and my wife? Or must we set up two DIFFERENT 401k plans, one for me, and one for my wife? We have a lot in common on investment goals, so I would prefer to have a JOINT 401k, if possible.

We both currently have idle funds in a Traditional IRA account, Could one or both of us roll the IRA money into a Solo 401k?

Hi Gary – You can set up a single 401k plan in which you both participate. A solo 401k is just a 401k for one person. When a second is added, you then convert it to a regular 401k. In that way, you could each have your own plan within the same 401k. You should be able to roll over the IRA to the 401k – that’s known as a reverse rollover.

Hello, Can you start your own business under a real estate LLC in January under your solo401K? If you end your job in December and you need to rollover your IRA and 403B in January to solo 401K, is that possible? Also since this is your own business, can you get paid under your solo 401K? if so, how much is the wage limit as a business owner?

Hi Tess – You can use a solo 401k as long as you have earned income from self-employment. However if the real estate LLC will be an investment business, you won’t be able to do it. You should be able to roll other plans into your solo 401k. I’m not sure what you mean by “get paid under your solo 401k”. There is no wage limit, but there is a maximum contribution of $53,000 ($59,000 if you’re 50 or older). You have a lot of questions, so I’d strongly recommend that you sit down and discuss your situation with a CPA. You want to be sure that you’re doing it right from the start.

Does it make a difference, in terms of deductibility, whether the source of the solo 401K contributions are from my (LLC) business account or personal account?

Thanks!

I don’t think so Chuck. They’re designed for the self-employed, including sole proprietors, who often use personal accounts for business purposes anyway. You might want to make the contributions from the business account as a way of maintaining a clear track record, just in case.

Can the employer contribution be based on the percentage of reported self employment income? And if so what percentage? Or does the SCorp have to pay the owner & spouse as employees via a w-2?

Hi Dawn – On an S corp it looks like the contributions can be based only on salary income. The profit distribution is considered to be like a dividend and therefore unearned. Retirement contributions can only be made from earned income.

Hi Jeff, your article was very helpful, but I am left a little confused. My partner and I have our business filed as an S-Corp. We have no employees today. Do we qualify for solo 401Ks? The article seems to indicate yes, but some responses to previous comments indicate no.

We also may eventually hire employees, but they will be part time (less than 1000 hrs/yr). That should allow us to continue with the Solo 401K plan, correct?

thanks

Hi Laura – If you do, it looks like you can make contributions only on the portion of income you take as salary, but not profit distributions. Here’s what the IRS says about the solo 401k and S corps:

Hi, I filed for tax extension due on Oct 2016 for tax year 2015. I have a solo 401k trough etrade. I earn close to 200k. I need help understanding the deadlines. Does the individual contribution must be made by end of January 2016 for tax year of 2015? and then contribute the additional profit sharing until my extended tax filing are due which is Oct 2016? I want to contribute the max of 53k, but i am not sure about the individual contribution deadline. I have not contributed at all yet. I was going to send a one whole scope.

thanks

lesh.

Hi Lesh – You practically need a matrix to figure that out. If your business is taxed as a sole proprietorship, then you have until your extended filing date. If you are taxed as a corporation, then salary deferrals must be made by Jan 15 of the following year (as in Jan 15 2016 for 2015), and profit sharing contributions must be made by the corporate tax filing deadline, which is March 15, or September 15 if you extended.

Jeff,

If I have a LLC with just myself and my wife. What would my 401k employer contribution deadline be? is it March 15, or September 15 if I extended.

Is it Net Profit (revenue – all expenses) calculated before or after 401k employer contribution?

Thanks a lot

Hi duc – That’s actually a bit complicated, and depends on a few things. I’m going to refer you to this article.

I have a full time job and have been flipping houses on the side. I would like to put my house flipping business under a LLC and then put all profit from that into a solo 401k plan. Can I put all my profit from my LLC in my Solo 401k?

I think you’re on solid ground there Kyle. For the purposes of a solo 401(k) the IRS considers just about any self-employment income to be acceptable for the plan. Setting up the LLC will make a strong case. Good luck!

Thanks you. I have read that I could only put 25% of my LLC profit into the Solo 401k plan. Is that the case in this scenario or can I put all profit up to $50,000 into the plan?

Hi Kyle – You can put 100% of your first $18,000 (or $24,000 if you’re 50 or older) in profit into the plan, as your “employee contribution”. You can then put 25% of the total profit into the plan as the profit sharing portion. But your combined contribution tops out at $53,000 (or $59,000 if you’re 50 or older). So if you have a $100,000 profit, you can contribute $18,000 as an employee, plus $25,000 ($100k X 25%) as profit sharing. That would give you a combined total of $43,000. Does that make sense?

Great article, Jeff, but I’m confused about the “net profit” for an S corp, given remarks about ‘including’ the shareholder’s salary. Say a sole shareholder anticipates 144,000 profit then decides to take a salary of 130,000 (after solo 401k deferral). May the shareholder then ALSO contribute 32,500 to the solo 401k and thus create a net ordinary loss in the S corp?

Thanks in advance, K

Technically speaking, the contribution doesn’t create a loss, because both the salary and the net income represent the shareholders total income. So yes, a $32,500 profit sharing contribution can be made.

Nicely written article. Here is my scenario: I am a sole proprietor for my LLC (filing as S-CORP). My income is approximately 130000 pretax.My wife is employed full time and her annual income is 105000 pretax. She has 401k contributions through her employer. Can I contribute to solo 401k?

Hi Shiva – I don’t see why not. You qualify based on your business, and your wife’s income doesn’t matter.

Great article! I have just incorporated my own S-Corp. I’ll be opening up a Solo 401k for myself. Now, what I’m unclear about is am I allowed to open up another Solo 401k account and fund it from my S-Corp for my wife noting that she has absolutely no involvement with my S-Corp? In fact, she’s employed full-time elsewhere and has her own 401k account with her employer. Please clarify. Thanks!

Hi Sanjay – Your wife can only participate in the solo 401k to the extent she has income from your S Corp. The income from her full time job doesn’t count. Also, her contributions will be reduced from the $53,000 maximum contribution to the solo 401k (which is also limited by her income from the S Corp), by the amount that both she and her employer contribute to her 401k at work. Hope this helps!

I know this is an old thread… but…

I have been self-employed for more than two years and set up a Personal 401K at Vanguard. One of the best things I ever did.

Not only have I contributed lots more to my own 401K than I ever could when I was employed by some one else’s company, but making such a large contribution (employee+employer), it lowers my tax bill when I get to do my annual taxes.

If retired, with some 1099 self employed income, can I also count income from exercising and selling same day stock options as eligible for solo 401 K income?

Hi John – You can use the 1099 income, but the stock options are a potential issue. If they come from an employer, they’re not eligible income. If they are investment income, then the only way they might be counted is if you’re business is investing. Please consult with a CPA on this question, as it gets complicated.

What if you have an S corp with multiple owners? Is the solo 401k still an option? Is there a minimum ownership requirement?

Hi Nicole – It’s my understanding that a solo 404k is for a one-person shop (and the spouse). If there are any others involved, it’s no longer a solo 401k, but a regular 401k. That will mean that you’ll have filing requirements for the plan with the IRS. So the short answer is “no”, but you might want to check with a CPA to see if there are any exceptions.

Hi, how can I contribute to my solo 401k account without running payroll?

Is it possible to deposit to 401k?

Hi Srimaha – I’m not sure of the mechanics of making contributions, but the solo 401(k) is based on your net income from the business. That means you don’t have to draw payroll. And if you’re a Schedule C sole proprietor, you won’t have payroll anyway. Just make sure that the amount of the contributions doesn’t exceed your income – the penalties are stiff if you do. Also, income in this case is NET income, not gross income. It’s the profit on your business, not total receipts.

Do you have to have an incorporated business to set this up, or could I do this if I just clean houses for a few people?

Hi Nate – Nope, no incorporation required. You can be a sole-proprietor, a partnership or even a contractor and you can set one up. It’s really one of the most over-looked retirement options available to the self-employed.

So if my husband has a two member partnership ( files Form 1065), does he and his partner qualify for a solo 401(k)? What I am asking is can each of them have their own account or is it for the partnership as a whole?

Hi Megan – It would have to be set up as a separate account for each. If they do it as a partnership, it automatically becomes a regular 401(k). If they plan to hire employees, a 401(k) could be a good benefit to include. That would mean setting up the partnership 401(k). They might want to think about that.

Great article to help demystify all this solo 401(k) stuff. I am trying to understand if I work full-time with a 401(k) maxed at $18,000, how much total can I also put in a solo 401(k). I didn’t really find the answer 100% from this article. I am going to go back through and read it one more time just in case I missed it :-).

Great article, my question is if you defer 100% of my income into the solo 401k, can I still contribute to a traditional ira?

Hi Kelly – No you can’t. Your contributions into any retirement plan are tied to your earned income, and you cannot collectively contribute more than you earn.

Derek, if you’re already maxing out your employer 401k, then the only additional amount you can put into your Solo 401k is the Solo 401k employer match amount, which is 20% of your net self-employment earnings, up to $53k. You cannot make any further individual contributions, though. I just wrote a post about this (which you can check out via the link next to my name above).

A quick question: in my quarterly federal / state tax payment (as a sole proprietor), do I subtract the amount I have put into my Solo 401k?

For example, if in Q1 I receive 15k, and I put 3k in my Solo 401k, do I pay tax on 12k or 15k?

Thanks – just want to do it correctly the first time!

Hi MJ – If I understand your question correctly, you should base your quarterly tax estimate on the income after the solo 401(k) contribution is made (ie, the $12K). But there is a complication! The retirement contribution lowers your income for federal withholding tax purposes, but it doesn’t lower it for FICA taxes at 15.3%. So you will have to calculate your tax liability based on federal withholding on $12K and FICA at $15K. Does that make sense?

Generally speaking, when you set up tax estimates they should be based on your income over the course of the year, that way the number is consistent and you don’t have to constantly recalculate. If you have a tax preparer, they should have a strategy for this worked out. Otherwise be very careful in calculating your estimates. Make then to high and you’ll be making an interest free loan to the IRS. Make them too low and you’ll owe money at tax time, and maybe penalties and interest on top of it.

For what it’s worth, most tax situations are more complicated than we generally assume. That’s why I frequently recommend getting professional help.

I am 28 and am thinking of setting up a solo ira – but i might hire employees in the future , what happens to the solo ira if I hire employees

Hi Paul – I presume that by solo IRA you mean solo 401k? For the solo 401k, it stops being a it stops being a solo 401k. At that point it becomes a regular 401k, subject to all the rules of a group plan.

As far as what becomes of the plan if you hire employees, you need to speak with your accountant about what to do specifically.

I’m interested in a solo 401(k) but am slightly confused as to the definition of business owner. I am in a law group that has three partners and no employees. As far as the IRS is concerned are we individual business owners and therefore eligible to set up our own solo 401(k)?

Jeff,

I just quit my job to pursue purchasing a business of my own. I would like to rollover my 401k to a solo plan that I can borrow from to fund the purchase. After I buy the business, I will have employees. What can I do to rollover the old 401k from my old employer and still be able to borrow from it? Or is there another option I am missing?

Thanks

What about reimburseing myself for start-up costs of the Solo 401k LLC? If I contribute personal funds to start up the Solo K LLC account, can I then reimburse myself those start up costs once the account is funded by my rollover? Would that reimbursement come in the form of a 1099-R distribution or just reimbursement and therefore deduction of value?

I am an independant contractor, and have formed an LLC and business bank account into which all of my income flows. I have set up a solo 401(k) which is funded out of this business account. I maximize contributions (~$50K) to this 401(k) plan every year.

Recently, my wife became a contractor as well, but in a completely different field to me. Can I add my wife to my solo 401(k) plan? Do I need to add my wife to my LLC to do this, and have her bill invoices to that LLC?

Note that the limited-liability aspect of the LLC is actually not a real concern. Ultimately, I’m just trying to find the easiest way for my wife to stash most of her income in a 401(k) plan.

Obviously, I should consult a finance professional, but am looking for guidance to prepare myself. Thanks!

Hi Have a question about solo 401k plan with ‘s’ corp with partnership.

I have partner and my wife is working for company, can i still open Solo 401k without breaking common law employee rule?

I understand that with a SOLO 401K that contributions (“employee” and “employer” portions) can be set up for the owner’s spouse. However, I’ve found few rules or instructions for how to set up an account for the spouse. Do we have to designate a salary for each of us?

@Tim You don’t need to have a salary, it would be based on the business income. Definitely meet with a CPA to make sure it’s done properly.

You’ll need a W-2 for your spouse – you could do it as a one time payroll or salary. The first $17,500 employee contribution for the spouse is the most tax advantaged (no Fed, no State just SS/Medicare) after than you’re paying SS/Medicare on $4 for every $1 the employer contributes – can still be tax advantageous depending on your bracket.

I just saw this reply and I’m under the same situation. I’m have a sole proprietor LLC and have setup a solo401K plan last year. However, this year, I plan to include my spouse to lower our income tax. I have not setup payroll for my spouse yet. Can I still pay my spouse one lump sum payment at the end of the year to maximize her deferred contribution of $18K? Will her deferred contribution affect my maximum contribution of $59K (both deferred and profit sharing for over 50) meaning can she deferred $18K in addition to my $59K maximum contribution?

Thank you!

Hi Nancy – I believe you can, since it’s your spouse. But please, please, please discuss this with your tax preparer/CPA. It is a very special situation that will require specific procedures.

Jell,

My husband’s and my business is a c- corp. We both have an IRA. Because of our profits this year, at age 69, he plans to contribute to a solo 401k. I would like to be able to do the same. I am 70.5 but understand that as long as I am still drawing a salary, I can participate in a solo 401k( but no longer can contribute to my IRA). We are finding conflicting restrictions regarding my owning over 5% of the business and because of that, my eligibility to participate. Thanks

Jeff,

I have an S corp, and the only employee, 54 years old in my corp. I set up a solo 401 k. ADP takes care of my payroll. I have finished maxing out on the 17,500.00 on my salary deferral amd 5,500.00 on my catch-up. I would now like to start putting in money to the employer contribution. Will that employER (me) contribution still be pre tax like the employEE (me) contribution. If the employEE deferral was under the deduction part of my payroll where would the employER contribution be. Is it also under deduction?

@ Marie It would also be a deduction but unfortunately I’m not qualified to know where. Why? Because my CPA handles all that for me. 🙂

I have a meeting with him in a month or so and I’ll be sure to inquire.

The Employer contribution is sort of a hybrid of pre and post tax. Say you make $100k in W2 earnings and then contribute $25,000 (as an Employer) to your solo 401k. The $20,000 contribution is subject to Social Security and Medicare taxes (both employee and employer contributions; $3060 total) but is not subject to Federal or State withholdings and will be considered an income deduction on your return.

What type of financial instruments and or trading activity is allowed with a self-directed 401k? For example if you have a self directed 401k with TD Ameritrade you cannot short stock.?.? Can you do puts with Options with a self directed 401k account.

@ Ron It’s not so much what’s allowed in a Solo 401k vs. what the custodian will allow (in your example, TD Ameritrade).

For example, you could buy real estate in a self-directed 401k but TD Ameritrade, as your custodian, probably wouldn’t allow it. You would have to find a custodian that would.

I have an individual 401k with TD Ameritrade and yes you can do options. You have to apply to TD Ameritrade and detail your trading experience to get access to Options trading but it’s a relatively painless process.

I am still not sure what is best any more. I have time but is this something you suggest is better setting up now or later? I just started my business and I am not investing anything yet not sure if I should figure out what to do now and get it over with or wait until more income is coming in.

@ Thomas I wouldn’t set a Solo 401k until you were in a position to start funding it. Starting with a regular IRA would be sufficient.

“Like the regular 401k contribution limits for 2011, you can elect to defer up to $16,500 of your pre-tax income”

To use the phrase “your pre-tax income ” is a bit misleading. And, in my case, this kind of language in a lot of solo 401K articles led to a big error on my part. I over-contributed to my solo 401K because I didn’t realize that contributions can’t be any more than your NET PROFIT or NET EARNINGS (your income minus your expenses). I thought it was just income.

So now I have to withdraw the excess contribution and pay taxes on it. Luckily, if I do it before the same year’s tax deadline (4/15) I won’t have to pay the 10% IRS penalty which would be painful.

So please be careful with your language!

Also , here:

“On top of the $16,500, as the employer you can also make a profit sharing contribution up to 25% of your pay (which would be based on your W-2), not to exceed $49,000 for 2009. (I have an example below)”

People might be misled here. It would only be based on your W-2 income if it’s you have a CORPORATION with its own W2s.. But not all self-employed people with solo 401Ks are corporations! Myself included. So, people might be misled that W-2 refers to the W2 income they get from a different employer. I was confused anyway and headaches have resulted. We’re only talking about W2 from your own business here.

@ Jimmy

Apologize for any confusion. I also have a Solo 401k and wasn’t confused, but can see how others could be. I’ve published your comment so that others could benefit. Thanks!

Hi Jeff,

I am in the IT consulting business, incorporated as an S corp and make an hourly rate. My gross payroll is 137K and Net Payroll (after 401K and Employment Taxes) is $82K. I set up the Solo 401K and contribute 25% of my my gross payroll as follows to max out the $49000 limit:

Employee Deferral 401K $16500

Employer Contribution to Solo 401K 32500

Is this the correct way or do I need to calculate 25% of Net Payroll ?

Also How can I contribute for my wife. She be a share holder of my S corp, if that what it takes ?

Thanks in advance

Raj

Do you set up solo401ks? What is cost?

@ Rod

I personally do not set them up, but I am an affiliate of the Nabers group who set mine up. Cost really depends on how many bells and whistles you want. With my Solo 401k, I can pretty much invest into anything that I want (some restrictions obviously apply).

Regarding cost, I wouldn’t suggest going with the cheapest provider. I’ve seen some anywhere from $250 as high as $5k. I paid around somewhere in the middle.

Setting up a solo 401k with TD Ameritrade is free with no ongoing fees and a relatively painless process. A lot of others I looked at (Vangaurd, Fidelity) had ridiculous fees for what is basically a brokerage account with ‘401k’ appended to it. Don’t be fooled.

@ C Do they file your 5500 for you?

no. but for a solo 401k it’s relatively painless.

C Valentine, would you still recommend TD Ameritrade? I am setup with another custodian and paying $600 annually without seeing any value.

I understand the IRS does not require a custodian for SoloK plans so I am questioning the pros and cons.

I would definitely recommend TD Ameritrade. There are no fees and I have options trading enabled. The downside is that TD Ameritrade individual 401k accounts do not allow loans. ( I’d definitely advise against taking 401k loans out in general but still you can’t get one with TD). The setup process took me about an hour. As I noted above to Jeff’s question about form 5500 filing – no, TD Ameritrade does not file a 5500 for you. To be honest it’s got to be a rare individual that has over $250,000 in a solo 401k and can’t quickly learn how to file the relatively simple form 5500EZ.

To be completely honest, I really don’t understand what the others like Fidelity and Vanguard are charging for? I mean it’s simply a brokerage account with a different name and tax treatment.

Not sure what the poster here is reading, but the Vanguard and Fidelity solo 401k plans have no associated fees (completely free), and in general, don’t have trading fees either. There may be some brokerage fees if you are trying to trade frequently in those accounts, and investing directly in stocks rather than mutual funds, but if you are simply doing normal things, there are no costs of ownership at all.

I don’t know what you are talking about relative to a Vanguard solo 401k and fees. I have one, and there are No fees. Also have a TD brokerage account, so no vested interest. Suggest you get your facts straight and not spread misinformation.

In

I did my research few years ago, and decided to open one up with Etrade. The reason I liked Etrade is because they allow you to take a loan (up to IRS limit 50k), If you ever need some money in the future and pay it back slowly (i.e. buy a home). The rest of them didn’t offer this. i.e. I looked at Fidelity, Scottrade, Vanguard and Etrade. I hope this helps. There is little more paperwork than SEP but just talk to one of their reps and they will help you. The other reason going with solo401k is better is because lets say you have a down year and you earn like 18k. If you don’t need the money, you can still contribute for that down year up the the individual limit vs. SEP, you can only put 20-25% of the income which would be like 4k. good luck.