A 529 College Savings Plan is one that allows parents to put aside money for the future higher education expenses of their children.

This plan is one of the best ways to save because, unlike most other savings plans, education-related withdrawals are free from federal income tax. Many states have chosen to adopt the same policy and also allow tax-free withdrawals for qualified expenses.

When we had our first son, it was a no-brainer to open a 529 plan to save for his college. We have followed suit opening a new plan with each child. Well….almost. Our now two-month-old doesn’t have one yet, but soon will. 🙂

Note:

Table of Contents

Performance of 529 Plans

Earnings from 529 Savings Plans are based on the performance of their investments, usually mutual funds. These plans are only administered by states.

An interesting fact about 529 Plans is that you can choose to invest in one from any state. And almost every state has one.

State plans are often different from each other in one or more of the following ways:

- Structure of the plan

- Type of investments offered

- Benefits for out-of-state/in-state investing

Check Your State First

If you are interested in starting a 529 College Savings Plan, you should first look at the plan your state offers.

Although most states allow non-residents to invest, there are usually advantages to investing in your own state’s plan including:

- State tax advantages and deductions – some states give tax-free status only to residents

- Matching grants

- Opportunities for scholarships

- State financial aid exemptions

- Creditor protection

Definitely go with your state if it gives deductions and/or credits on your tax return. This state tax break will most likely be a bigger asset than the possible lower fees from another state.

The state of Illinois just increased the state tax rate from 3 to 5%, to give me even more incentive to use our state plan. New York, Minnesota, Missouri, and Michigan offer exceptional plans for their residents.

Some states are so forward-thinking that they give their residents a state tax break no matter what state plan they invest in. Pennsylvania was the first state to do this.

If your state does not fall into this category and does not offer enough incentives to its residents, there are a number of states with a proven track record.

Year after year, these states have had some of the best 529 College Savings Plans:

Best 529 Plans: A State-By-State Guide

New York: New York’s 529 College Savings Program (Direct Plan)

Managed by Vanguard, one of the world’s largest investment companies, this plan offers low fees, a variety of investment options, and robust performance. Residents can deduct up to $5,000 ($10,000 for married couples) of contributions from their state taxable income.

California: ScholarShare 529

California’s ScholarShare 529 is lauded for its diverse investment portfolio and low fees. With no state income tax benefits, it still stands out as a top choice due to its overall performance and strong reputation.

Illinois: Bright Start College Savings Program

Illinois’ Bright Start program offers a unique blend of low fees, strong investment performance, and substantial state tax benefits. Contributions are deductible up to $10,000 ($20,000 for married couples), making it an attractive option for Illinois residents.

Texas: Texas College Savings Plan

While Texas does not offer state tax deductions (due to the absence of state income tax), the Texas College Savings Plan stands out for its low fees and diverse investment options. It is a solid choice for residents and non-residents alike.

Ohio: Ohio 529 CollegeAdvantage

Ohio’s 529 plan is highly rated for its low fees, variety of investment options, and strong performance. State residents can deduct up to $4,000 per beneficiary from their state taxable income, with unlimited carry forward of excess contributions.

Michigan: Michigan Education Savings Program (MESP)

Managed by TIAA-CREF, the Michigan Education Savings Program stands out for its diverse investment options, low fees, and strong performance.

Michigan residents can benefit from state income tax deductions on contributions up to $5,000 per year for single filers and $10,000 for joint filers.

Virginia: Virginia529 inVEST

Virginia’s 529 inVEST plan is highly regarded for its strong performance, low-cost investment options, and state tax benefits. Contributions are deductible up to $4,000 per account per year with unlimited carryforward, making it a great option for residents.

Maryland: Maryland College Investment Plan

Managed by T. Rowe Price, the Maryland College Investment Plan offers a variety of investment options, competitive fees, and a state income tax deduction of up to $2,500 per beneficiary.

This plan is an attractive choice for Maryland residents aiming to balance performance and tax benefits.

Utah: Utah Educational Savings Plan (UESP)

Utah’s 529 plan is lauded for its low fees, variety of investment options, and consistently strong performance. While it does not offer state tax benefits, its overall appeal makes it a popular choice for residents and non-residents alike.

Nevada: The Vanguard 529 College Savings Plan

Offered by one of the most trusted names in investment, The Vanguard 529 College Savings Plan is Nevada’s premier option. With low fees, a wide array of investment choices, and the backing of Vanguard’s expertise, it stands out as one of the nation’s top plans.

Nevada does not offer state tax benefits, but the plan’s overall quality makes it a worthy consideration for savers nationwide.

Florida: Florida 529 Savings Plan

Florida’s 529 Savings Plan is celebrated for its varied investment options and competitive fees. While Florida does not have a state income tax and thus offers no state tax deductions, the plan’s low costs and solid performance make it a strong contender for residents.

Minnesota: Minnesota College Savings Plan

The Minnesota College Savings Plan is known for its diverse investment options, managed by TIAA-CREF, and a state income tax deduction of up to $3,000 per year for joint filers ($1,500 for single filers).

This plan represents a solid blend of performance and state tax benefits for Minnesota residents.

Some of these plans are direct-sold, meaning you purchase the plan directly from the state. This is the way to go as broker-sold plans usually include sales charges, although they offer slightly more investment possibilities.

Many of the best plans are managed by Tiaa-Cref, Fidelity, or Vanguard. In fact, those plans generally charge the lowest fees.

Factors to Consider When Choosing a 529 Plan

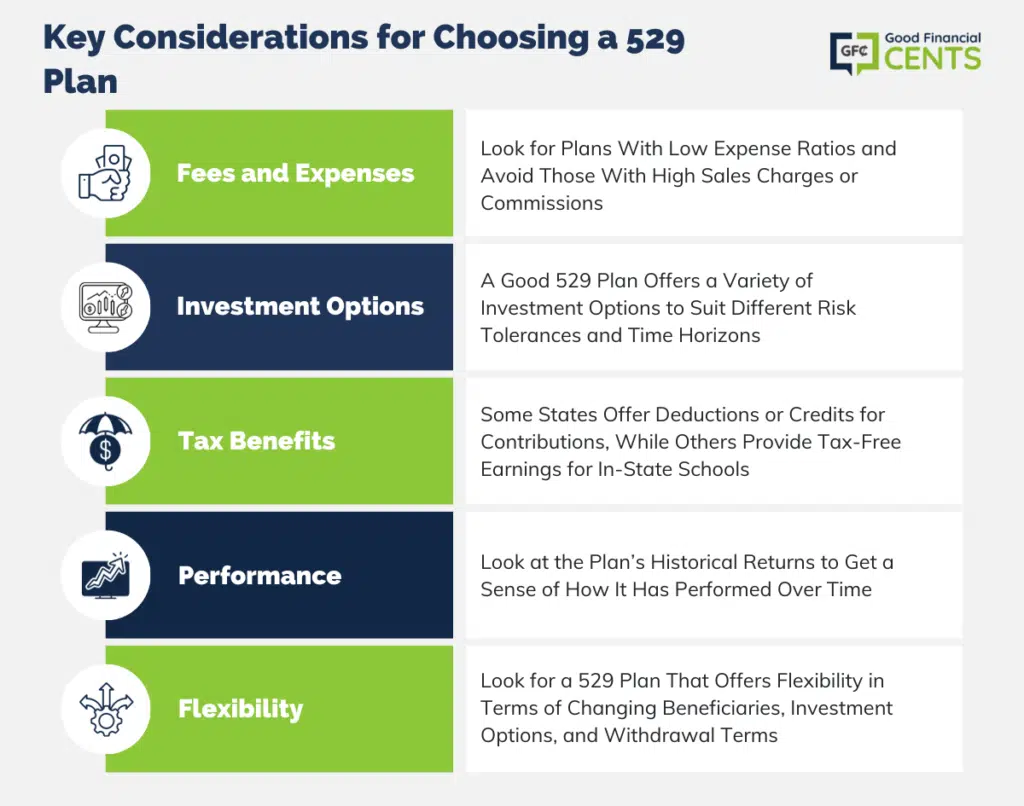

Fees and Expenses

High fees can eat into your investment returns over time. Look for plans with low expense ratios and avoid those with high sales charges or commissions.

Investment Options

A good 529 plan offers a variety of investment options to suit different risk tolerances and time horizons. Age-based portfolios, which automatically adjust their asset allocation as the beneficiary gets closer to college age, are a popular choice.

Tax Benefits

While all 529 plans offer federal tax-free withdrawals for qualified expenses, state tax benefits vary. Some states offer deductions or credits for contributions, while others provide tax-free earnings for in-state schools.

Performance

While past performance is not indicative of future results, it’s still worth considering. Look at the plan’s historical returns to get a sense of how it has performed over time.

Flexibility

Life is unpredictable, and your needs may change. Look for a 529 plan that offers flexibility in terms of changing beneficiaries, investment options, and withdrawal terms.

It is amazing that you can choose to invest in a 529 College Savings Plan from almost any state in the country. With such a selection, you are sure to find the perfect investment opportunity for you and your college-bound child.

The Bottom Line: Every Bit Helps

Saving for college is a marathon, not a sprint. Even small contributions to a 529 plan can add up over time, helping to reduce the financial stress of higher education.

By choosing the right plan for your family and starting early, you can make the dream of a college education a reality for your loved ones.

As you navigate the world of college savings, remember that every bit helps, and the best time to start is now. With the right plan and a commitment to saving, you can provide your children or beneficiaries with the gift of education and a brighter future.

I’m glad that I don’t have kids yet because I don’t think I am the best position to start creating a college savings plan for them