When it comes to filing taxes, there are certain smart tax moves that financially successful people always do. Whatever your financial situation, it’s a good idea to adopt this mindset to position yourself well for current and future filings.

To help you in the process, TurboTax offers user-friendly software that guides you through the labyrinth that is the tax code.

Get started with TurboTax today.

Now here are those tax moves you should consider making.

Table of Contents

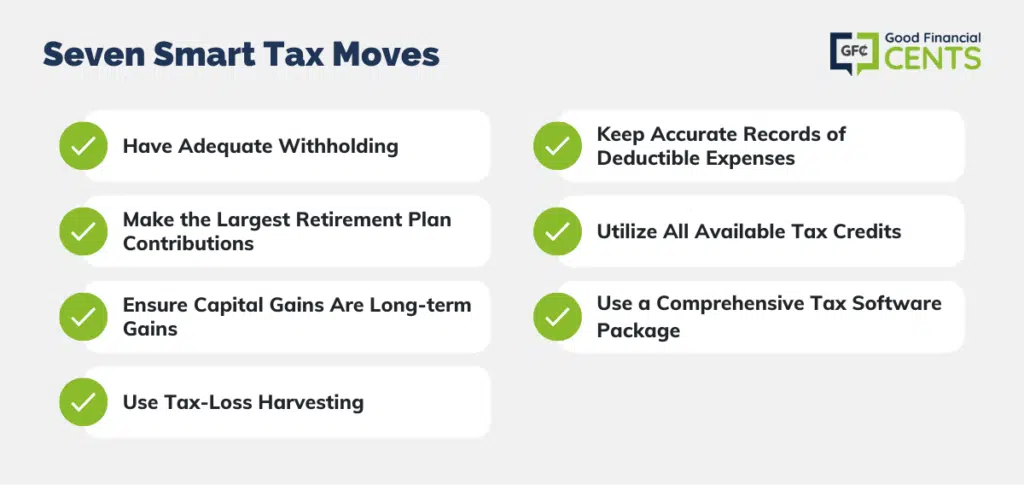

- 1) Have Adequate Withholding – Not Too Much, Not Too Little

- 2) Make the Largest Retirement Plan Contributions Possible

- 3) Make Sure Your Capital Gains are Long-Term Gains

- 4) A Little Bit of Tax-Loss Harvesting Goes a Long Way

- 5) Keep Accurate Records of All Deductible Expenses

- 6) Be Sure to Take Advantage of All Available Tax Credits

- 7) Use a Comprehensive Tax Software Package

1) Have Adequate Withholding – Not Too Much, Not Too Little

You’ve probably heard having a big tax refund is like giving the government an interest-free loan. And even though it’s something of a cliché, it’s actually true!

While a lot of people are excited over the prospect of getting a big income tax refund, the reality is you probably have much better things to do with the money. For example, you might invest it to earn even more money.

Or you might use it to pay off a credit card that is charging you double-digit interest rates. Either use of the money would be better than allowing the government to accumulate it with no benefit to you.

In truth, good tax planning is all about coming as close to zero with your tax liability/refund as possible. Though it’s unlikely you can plan your tax liability/refund to come out to exactly zero, getting to within a couple of hundred dollars is an excellent strategy.

Make sure your withholding or your tax estimates (if you’re self-employed) come as close to your expected tax liability as possible, without substantially exceeding it.

A lot of taxpayers are worried about owing tax, but there’s actually quite a bit of flexibility there. As long as you pay at least 90% of your actual tax liability, you won’t get a penalty for late payment. Another penalty-avoiding strategy is to make sure you pay enough tax to cover 100% of the previous year’s tax liability.

Either way, you will have at least most of your tax liability paid, without having to incur IRS penalties for late payment.

2) Make the Largest Retirement Plan Contributions Possible

For most taxpayers, making contributions to a tax-deferred retirement plan is the single biggest and best way to lower your current tax liability. Not only does the contribution lower your current tax bill, but it also enables you to build up investment capital that will earn tax-deferred income for your retirement.

In short, it’s the best investment deal available. For that reason, you should take advantage of it to the greatest degree possible.

For 2025, you can contribute $23,000 into a 401(k), 403(b), 457, or Thrift Savings Plan (TSP). If you are age 50 or older, the contribution can be as high as $30,500.

Over and above an employer-sponsored retirement plan, you can also contribute to a traditional IRA. You can contribute up to $7,000 per year, or $8,000 per year if you are age 50 or older. Even if you are covered by an employer plan, you may still be able to make a tax-deductible contribution to a traditional IRA.

How effective are tax-sheltered retirement plan contributions at reducing your tax liability?

Let’s say you’re in the combined 30% tax bracket, assuming 25% for federal, and 5% for your state. If you can contribute the full $23,000 into an employer plan, plus $7,000 into a traditional IRA, you will be able to reduce your taxable income by a total of $29,000.

If you have a marginal federal and state tax rate of 30%, a $29,000 contribution to both a 401(k) and a traditional IRA may reduce your tax bill by $8,700!

You can make a tax-deductible contribution to a traditional IRA, if you qualify for the deduction, up until the tax filing deadline (either April 18th this year or October 15 if you file an extension). 401(k) contributions have to be made by December 31 of the actual tax year, so you can’t change your contributions for 2025. However, you can make adjustments now to max out your contributions for 2024.

3) Make Sure Your Capital Gains are Long-Term Gains

The tax code provides a generous tax break for long-term capital gains, in the form of a reduced tax rate. Short-term capital gains, which are gains on assets that have been held for one year or less, are taxable at ordinary income tax rates. Long-term capital gains – gains on assets held over one year – have lower rates.

Long-term capital gains tax rates look like this:

- If your ordinary income tax rate is 15% or less, then your capital gains tax rate is zero (I know, not bad, right?)

- If your ordinary income tax rate is between 25% and 35%, your capital gains tax rate is 15%

- If your ordinary income tax rate is higher than 35%, then your capital gains tax rate is 20%

If you are in the 15% ordinary income tax bracket, and you have a short-term capital gain of $10,000, then you will have a $1,500 income tax liability. But if you hold the asset long enough to make it a long-term capital gain, you won’t have to pay any tax on it at all.

The Moral of this Story

4) A Little Bit of Tax-Loss Harvesting Goes a Long Way

Tax-loss harvesting isn’t a new concept, but it’s gaining popularity now that some investment platforms, such as Betterment and Wealthfront, offer it as a feature as part of their programs. But just about any investor can take advantage of tax-loss harvesting. And it can make a big difference when you are filing your income tax returns.

Tax loss harvesting is basically a strategy in which you sell certain investments at a loss, in order to offset the tax liability created on other investments that are sold for large gains. Since capital gains taxes do not apply to tax-sheltered retirement plans, the strategy is used only with regular taxable investment accounts.

For example, let’s say you have $20,000 in capital gains on a group of winning investments. You can reduce the tax liability from those gains by selling off other investments that have been falling in value. Those losses will offset at least some of the gains you made on the stronger investments.

If you have $10,000 in losses, that will cut your taxable gains in half. If you’re in the 25% tax bracket, and the gains are short-term capital gains, then you will save $2,500 in taxes using this strategy.

You may even consider buying back the investments you sell for tax-loss harvesting at a later date. The IRS does impose “wash sale rules” that are designed to prevent the abuse of tax reduction strategies. Generally, you are not permitted to repurchase the same or substantially identical investment securities within 30 days of selling them. But if you want to buy back the investment, without incurring the wash sale rule, you must defer the repurchase for at least 31 days. But then again, you may just want to use the cash to buy an entirely different investment.

5) Keep Accurate Records of All Deductible Expenses

It’s fairly easy to document major deductions, such as mortgage interest and real estate taxes. But it’s a lot more difficult when it comes to deductions that are made up of small, regular expenditures. Examples include medical expenses and charitable contributions.

You can have dozens of co-pays for doctor visits and prescriptions, and lose track of how many and how much. The situation can be even more extreme with charitable contributions. Though you may have a few large contributions paid by check or credit card, it’s also likely to have a much larger number of smaller contributions, such as contributions in church, or to charities soliciting at your door.

6) Be Sure to Take Advantage of All Available Tax Credits

We’re not going to go into a lot of detail here, except to say tax credits are always worth taking because they reduce your actual tax liability and not just your income. Some of the biggest tax credits available include:

- Earned Income Credit

- Education Tax Credits

- Savers Credit

There are actually a lot more credits available. It’s not always easy or apparent as to what they are, when you qualify for them, or how much you can receive. That’s why you need to get some kind of help in preparing your tax return, in order to maximize those benefits.

7) Use a Comprehensive Tax Software Package

Hopefully, you’re not still doing your taxes manually! And if you want the luxury of doing your taxes yourself but also being able to talk to someone you can use TurboTax online.

TurboTax is the most popular because it’s the very best available, and comes with a very affordable pricing schedule.

It offers four different plans, based on the complexity of your tax situation. The pricing runs from zero if you file a 1040EZ or 1040A, to less than a little over $100 if you own a business.

TurboTax asks a simple question about questions about you and gives you the tax deductions and credits you are eligible for based on your answers. TurboTax searches for over 350 of them.

With TurboTax DIY also means you are not alone. You can connect live via one-way video to a TurboTax Expert or credentialed Tax Expert with TurboTax SmartLook™ to get your questions answered when you need to.

You can also jump-start your taxes by snapping a photo of your W-2 and TurboTax automatically puts your information directly on your return. With TurboTax, you don’t need to know anything about tax laws or tax forms.

Whether you’re seeking professional assistance or tax software, going taxes alone is one thing you can easily avoid. The IRS tax code can seem overwhelming but it shouldn’t be, especially if seek help.

That’s what making smart tax moves is all about!

If you need help getting your taxes done the smart way, you can start for free at TurboTax.com.

Thank you for these tips, Jeff. Nice and useful article.

Personally for me tax system is something incredibly difficult and troublesome. I used to ask my husband to do all the calculations for me but TurboTaxes changed my life in a better way. It decreased workload both for me and attention of my husband is not distracted to the things he doesn’t want to do.

Great tips Jeff. I don’t have all of my tax forms just yet, but I have the important ones in order to get an idea of how my refund will look like. I was able to plug the numbers in TurboTax and saw that my refund was a little higher than anticipated.

That’s slightly good news but like you wrote I could have done better things with that money during the year! But with that info I can now adjust my withholding so I won’t have as large of a refund next year.