Installing an anti-theft device on your motorcycle can be beneficial in more ways than one. Not only can an anti-theft device do its job and protect you against vandals and thieves, but having certain types of devices can even lead to lower motorcycle insurance premiums.

Before you run out and install an anti-theft device to save on insurance, however, it helps to know which devices deter thieves the best and which ones actually lower insurance costs. Believe it or not, insurance companies don’t offer discounts for having an anti-theft device.

This guide will break down which devices can make a positive impact on your premiums, how much you can save on motorcycle insurance, and other ways you can protect yourself.

- Anti-Theft Discounts

- How Much Can Anti-Theft Save You

- Other Ways to Save

- Ways to Prevent Motorcycle Theft

Table of Contents

Anti-Theft Devices That Help You Save Big on Motorcycle Insurance

While you may believe that any anti-theft device could help reduce your motorcycle insurance premiums, this isn’t normally the case. Like with auto insurance, companies that offer insurance in this space only offer discounts on certain anti-theft devices that might deter criminals the most.

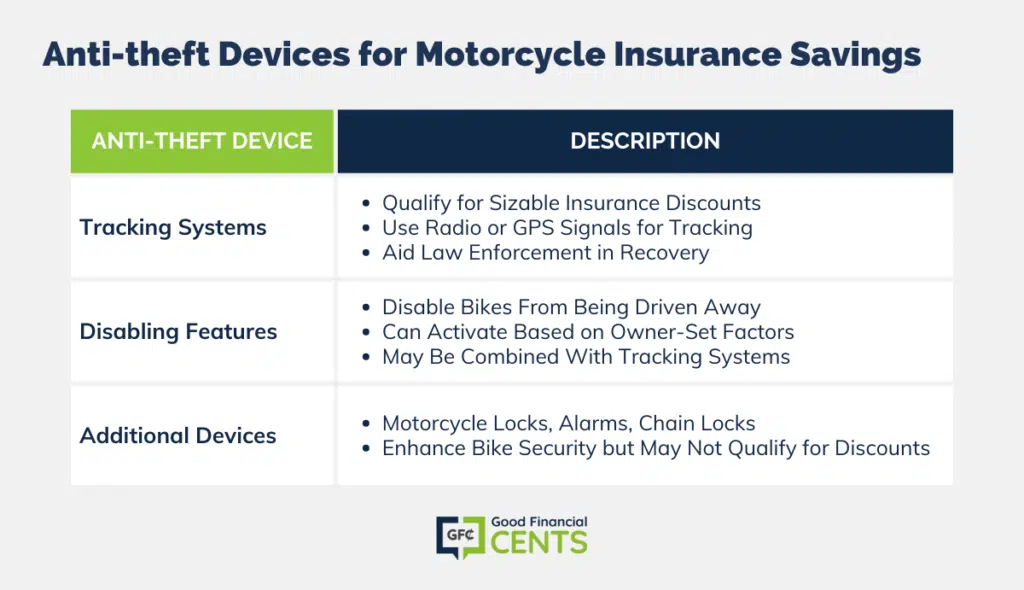

Anti-theft devices that lead to the biggest discounts include:

Tracking Systems

Owners who have a tracking system installed on their motorcycle are most likely to qualify for sizable insurance discounts. A tracking system allows motorcycle owners to use radio or GPS signals to track down their bike once it’s been stolen.

While owners should never try to repossess a stolen bike on their own, they can use information from tracking systems to help law enforcement track down their stolen property so it can be returned.

Disabling Features

This type of anti-theft device may be offered on its own or in conjunction with a tracking system. Disabling features allow motorcycle owners to disable their bikes so they cannot be driven away. Some disabling features can even be set up to activate on their own based on factors the owner sets up themselves.

For the most part, anything you can purchase that will make it more difficult (or louder) to steal your bike will leave you better off. Just remember that only a few anti-theft devices can lead to savings on motorcycle insurance premiums.

Also, note that purchasing comprehensive coverage within your motorcycle insurance policy is another great way to recover from theft. After all, comprehensive coverage was created to cover losses not caused by an accident — for example, damage from hail or inclement weather or damage from vandalism or outright theft.

If you want to make sure you aren’t left in the lurch of a thief who takes off on your bike and never comes back, you’ll need to make sure your insurance policy comes with sufficient coverage for theft.

How Much Money Can You Save on Motorcycle Insurance?

How much you’ll save with an anti-theft device depends on several different factors. These can include:

- Which motorcycle insurance company you buy coverage from

- How much your premiums cost

- Which anti-theft device you purchase and install

With most companies, installing a qualified anti-theft device will help you save 10% off your motorcycle insurance premiums or more. Keep in mind, however, that some motorcycle insurance carriers will only extend this type of discount to customers who have an approved anti-theft device installed by a professional.

Others may let you install the equipment yourself, although you may need to provide proof of purchase.

Before you purchase an anti-theft device, it makes sense to find out which devices your insurance company provides discounts for and any requirements they have that might prevent you from qualifying.

Note:

Other Ways to Save on Motorcycle Insurance

Installing an anti-theft device is a smart way to save some cash on insurance premiums while protecting yourself from the drama of having someone steal your bike. However, there are other ways you can save on motorcycle insurance. Some of the best money-saving measures you can take include:

Shop Around and Compare Policies

One of the best ways to reduce motorcycle insurance premiums is shopping around to make sure you’re getting the most bang for your buck. Make an apples-to-apples comparison of different insurance companies to see how much you’ll pay for a policy with similar inclusions and coverage limits.

You may need to switch insurance companies to get the best deal, but the savings can be well worth it.

Choose a Higher Deductible

Motorcycle insurance policies come with an out-of-pocket deductible you must pay before coverage kicks in. With that in mind, it’s important to note that choosing a policy with a higher deductible can help reduce your annual insurance premiums.

Check for Other Discounts

Make sure to check for other motorcycle insurance discounts you could qualify for. While available discounts can vary, check for options like safe driver discounts, safety course discounts, multi-policy discounts, and policy renewal discounts.

5 of the Best Ways to Prevent Motorcycle Theft

According to the National Highway Traffic Safety Administration (NHTSA), more than 750,000 vehicles were stolen nationwide in 2017. That makes vehicle theft a multi-billion-dollar crime, but it’s also a crime that may be preventable.

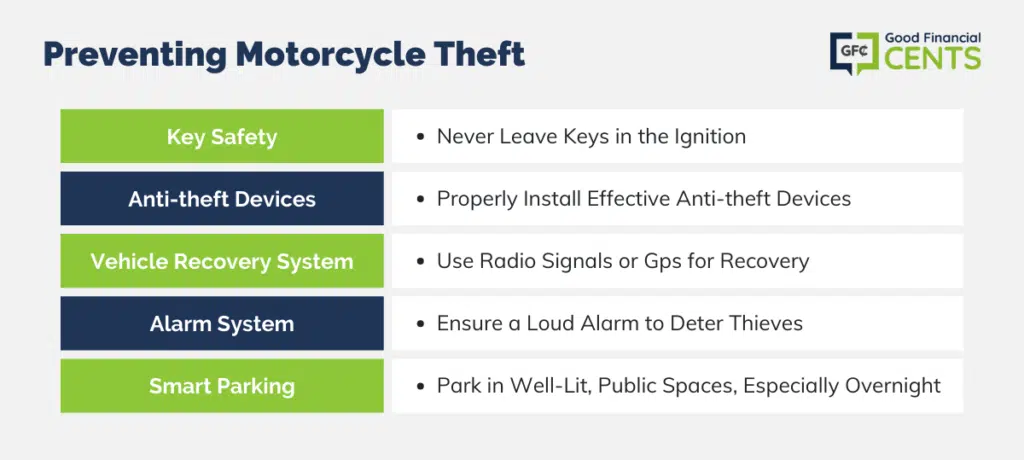

If your goal is preventing theft of your motorcycle or any other vehicles you own, there are some steps you can take right away that could help. Some tips from the NHTSA include:

- Don’t leave your key in the ignition. The NHTSA says that many motorcycles and other vehicles are stolen each year due to driver carelessness, including leaving the key in the ignition. Make sure you never leave your key in an area that’s easy to access or on the motorcycle itself while you’re away.

- Buy anti-theft devices and have them properly installed. Anti-theft devices that slow down the theft process or make it burdensome can go a long way when it comes to protecting your bike. Make sure any device you buy is properly installed to ensure maximum protection.

- Purchase a vehicle recovery system. A vehicle recovery system that uses radio signals or GPS can help you recover your bike once it’s already been stolen. This type of device may also lead to lower insurance premiums, so it could be a win-win.

- Purchase an alarm system. An alarm system, and preferably a loud one, can also help protect your motorcycle and your investment. Make sure your alarm is properly installed and loud enough to deter thieves.

- Park your bike in a well-lit, public space. If you’re planning to park your motorcycle in public — and especially overnight, make sure you look for a parking space that is out in the open with plenty of lighting.

Final Thoughts – Anti-Theft and Motorcycle Insurance

If you’re worried about theft, there are many steps you can take to protect yourself. For starters, you can purchase a wide range of anti-theft devices that might deter thieves, including recovery systems, disabling mechanisms, motorcycle alarms, and traditional locks and chains.

On a side note, you may also want to make sure your motorcycle insurance policy comes with comprehensive coverage that will replace your bike if it’s stolen and never recovered. This is crucial since, no matter how hard you try, some motorcycle thieves are so skilled that your anti-theft devices aren’t much of a deterrent.

Some of the best criminals know how to disable tracking devices and turn off alarms while they’re loading your bike onto their truck or flatbed. There’s nothing you can do about that except make sure you have proper motorcycle insurance coverage that will step in to help when you need it most.