On two wheels or four, you have the same goal: to get where you’re going.

But, oh, what a difference between a car and a motorcycle!

On a bike you’re more than just a passive viewer behind a windshield, you’re part of the landscape.

Your motorcycle insurance should also be distinct even though it shares a common goal with your car insurance: to protect your property and provide some backup if the worst happens.

While your car insurer may do a great job insuring your car, it may not necessarily provide the best motorcycle coverage.

When you’re shopping for a motorcycle, take a few minutes to learn the basics of motorcycle insurance and how to get the best coverage at the best price.

If you’re already a seasoned biker, check the mechanics of your policy to make sure it’s clicking on all cylinders.

Table of Contents

The Best Motorcycle Insurance: It’s a Packaged Deal

Like car insurance, motorcycle insurance comes as a packaged deal.

That is, you pay one premium which funds several different kinds of coverage:

- Liability — to pay for the other driver’s car repairs or car replacement, and to pay medical bills for the other driver and his or her passengers if you caused a wreck.

- Collision — to pay for your own bike repairs if you caused a wreck (meaning the other driver’s insurance wouldn’t be paying).

- Comprehensive — to cover other kinds of damages to your motorcycle. (Think hail damage, theft, etc.)

- Medical payments (MedPay) — can help pay your own medical expenses in an at-fault wreck.

- Uninsured/underinsured — could close the gap if someone who doesn’t have insurance or doesn’t have enough insurance collides with you.

- Add-ons — extra features to pay for towing or a rental while your bike is in the shop, for example.

In some cases, you can decide how much of each coverage to buy, and these decisions will directly impact your premium.

However, most states require a minimum liability coverage amount.

Does Motorcycle Insurance Cost More Than Auto Coverage?

Usually, an item worth more costs more to insure. Motorcycles cost less than cars, on average, so conventional wisdom may suggest lower insurance costs.

But insurance underwriters also consider the likelihood of a wreck, and motorcycles are more likely to be in wrecks. A lot more likely.

In fact, the National Highway Traffic Safety Administration’s most recent data says motorcycle riders are 28 times more likely than auto drivers to be in a fatal wreck.

This increased risk translates into higher premiums for motorcycle owners.

How Can I Find Cheaper Motorcycle Insurance Premiums?

Yes, motorcycles tend to cost more to insure, but you can still find ways to save money and have good coverage in place to protect your investment, yourself, and your financial security in case of an at-fault wreck.

Determine Your Actual Needs

It’s a simple equation:

The more coverage you have, the more you’ll pay in premiums.

You can control costs by carrying only the insurance you actually need (so long as you meet your state and/or bank’s minimum).

This doesn’t mean you should put yourself at risk by not buying enough coverage, even if you live in a state that does not require liability coverage for bikers. That’s not smart for several reasons.

But when you’re buying coverage or looking over the coverage you already have, make sure it matches the reality of your ride.

A bike worth $5,000, for example, won’t need $12,000 in comprehensive and collision coverage.

And decide whether you really need extra services such as roadside assistance or towing that your insurer may add to your policy.

We’ll go into more detail about customizing your coverage below.

Drive More Safely

This is the big one.

As I mentioned above, the federal statistics on motorcycle deaths are staggering.

Part of this comes from the nature of the beast.

Without airbags, roll bars, and other auto safety features, a motorcycle rider has much less protection during a collision.

Which is why it’s even more important to drive defensively and obey traffic laws on your bike.

Decreasing your accident risk will prevent costly premium increases resulting from traffic violations and wrecks.

Since underwriters determine a driver’s likelihood of being in a wreck based partly on your driving record, careful drivers have access to lower premiums.

Buy a Smaller Bike

Motorcycles with smaller engines usually cost less to insure. Again, this is directly related to accident risk. Smaller engines offer less power and speed so they’re less likely to be involved in wrecks.

If you want a big bike’s power and maneuverability, this may not be your way to save on insurance.

But if you’re in the market for a bike and haven’t decided which one to buy, it’s something to keep in mind.

And it’s not all about size: Sportier bikes tend to cost more to insure, too.

Look for Discounts

Most insurers offer discounts. Many even let you stack discounts to maximize savings.

Your current insurance company may offer discounts you don’t even know about.

Common discounts include:

- Multiple policies: Have more than one kind of insurance with the same company? Ask about a bundled policy discount.

- Safe driving: Your insurer may reward you with lower rates if you’ve gone several years without a wreck or traffic citation.

- Low or no claims: If you’ve never needed to file a claim, your policy has cost less for your insurance company which may result in a discount.

- Training course: Have you taken a motorcycle safety course, let your insurer know. It may help lower your premiums some.

Who’s Riding Your Bike?

Statistics show younger people drive more recklessly than older people. Sure there are exceptions, but underwriters go with statistical norms, so younger drivers will likely pay more for insurance.

When you’re young, there’s nothing you can do about it. Enjoy your youth and work hard to pay those higher premiums.

If you’re a little older, though, and you’re thinking about adding a younger driver to your policy, talk to your insurance agency about ways you can keep costs down.

Finding some other mode of transportation for that younger driver and keeping him off your policy will save a lot.

Consider Your Deductible

Your deductible has a direct impact on your premiums.

The higher your deductible, the lower your premiums.

A higher deductible means you’ll have to pay more out of pocket after an accident or theft before your insurance coverage kicks in.

This can be a slippery slope.

While it’s tempting to raise that deductible and enjoy the month-to-month savings, raising it too much will make it harder to access your coverage if you needed it.

If there’s no way you could come up with, say, $2,000 in any given week, a $2,000 deductible may be too high. When you can afford a higher deductible, though, it will pay off in premium rates.

Your Credit History

Research has connected lower credit scores with higher claims, so if your credit score needs improvement, you could be paying higher premiums.

Almost all states allow insurance companies to consider your credit history when setting your premiums. (Hawaii, California and Massachusetts are the exceptions.)

You can fix this by working on your credit score: Pay your bills on time.

Monitor your score using an online tool like Credit Sesame or Credit Karma in case one of your credit accounts makes a reporting error.

When you start seeing an improvement in your credit score, make sure your insurance agent is re-running your credit before renewing your policy.

Shop Around

Thankfully, the days of making dozens of phone calls to find the best insurance rates have passed. You can find and compare quotes online and find insurance companies specializing in the kind of coverage you need.

We’ll look at eight of my favorite motorcycle insurers below.

This doesn’t mean you shouldn’t find in-person help when you need it.

An independent agent in your area can help you compare policies from many different insurers so you can find a company that meets your needs.

Look For Lay-up Coverage

Bikers who live in cold weather states may go months without riding each winter. When your bike is covered and stored, couldn’t you just cancel the policy?

Repeatedly canceling and re-starting coverage has some disadvantages, including a potential for unnecessary fees and hassle. Also, what if someone broke into your garage and stole your bike while you had no insurance?

Some insurers offer a nice in-between: Lay-up policies for motorcycles.

This kind of policy reduces your coverage in months when you’re not riding without doing away with your protection altogether.

Ask your insurance company or your independent agent about lay-up coverage. And if you do go this route, make sure you don’t go out riding during the lay-up period since you wouldn’t be protected out there.

How Much Motorcycle Coverage Do I Need?

Remember the story of Goldilocks and the Three Bears?

Goldilocks had a real gift for finding balance in her life: not too hot, not too cold, but just right.

Goldilocks would have made a great insurance shopper because finding coverage that’s “just right” can make all the difference.

Going without enough coverage, for example, puts your bike and your health at risk, along with the property and health of other drivers and passengers.

And, if you caused a wreck and your policy didn’t have enough coverage to make things right, you’d be personally responsible to pay. If you couldn’t pay, a court could seize your assets.

On the flip side, having too much coverage means you’re spending too much on premiums.

Given a choice, I’d say this is preferable to inadequate coverage, but you could be saving or investing that extra money or at least taking some pressure off your monthly budget.

The best solution, of course, is the “just right” approach.

Finding Just the Right Level of Coverage

If insurance were as simple as Goldilocks’ porridge you could tell right away whether you had coverage that fits your needs.

In reality, finding just the right coverage takes a little more time and thought, but it is possible and worthwhile.

Going through the elements of a motorcycle insurance package one by one is the place to start:

Liability:

The question becomes: Is your state’s minimum requirement enough?

The Insurance Information Institute recommends at least $100,000 in bodily injury liability and $300,000 in total liability per accident. Many states’ minimum requirements come nowhere close to this standard.

You can save on premiums by sticking with your state’s minimum, but remember that you could be personally responsible for damages exceeding your coverage amount.

Finding the right balance will be up to you. A good general rule, though, is to have enough liability coverage to protect your financial assets such as savings, real estate investments, and so on, from seizure.

If your assets exceed the limits of a standard policy, ask your agent about an umbrella policy which can extend your liability coverage.

Collision:

If you’ve paid off your ride, collision coverage may be optional. Going without it can save a lot in monthly premiums, but it also puts your property at risk.

Unless you can afford to quickly and easily replace your bike, you probably need collision coverage to match the market value of your bike.

But you may not need collision coverage if:

- Your motorcycle isn’t worth very much: If your bike is old and not worth much on the market, collision insurance may not be worthwhile. Rather than paying premiums for collision, you could save that money for replacement costs.

- You’re an infrequent rider: If your motorcycle is paid off and you seldom ride it, paying for collision coverage will be less of a value. That being said, you’d still be taking a risk when you do ride.

- You wouldn’t replace it anyway: You could also skip the collision coverage on a bike you’d never replace or repair after an accident. This may be true for someone with an old bike in poor condition.

Again, it’s your decision. There’s a “just right” scenario for you somewhere on the spectrum between not enough and too much coverage.

Comprehensive:

When you’re shopping for your coverage, be sure to find out whether your comprehensive (and your collision) would pay actual cash value or a stated value:

- Actual value: Pays up to the value of your bike. If you have an 8-year-old Triumph, insurance adjusters will base your claim on the value of an 8-year-old Triumph and not the original price of the bike.

- Stated value: When buying coverage you can state the value of your bike and use your stated value as a standard for claims. This is a helpful feature for someone who has restored a classic bike since the book value may not reflect the money and time invested. Expect higher premiums for higher stated values.

Just like with collision coverage, you’re protecting your own property with comprehensive coverage. It’s up to you to find the right balance.

Medical Payments:

Hopefully, your health insurance would be up to the job of protecting you from these astronomical expenses. If not, or if you’d like to have extra protection, medical payment (MedPay) coverage could help.

MedPay is optional in most states, but you know your own situation better than anyone else and should get coverage to fit your life.

Uninsured / Underinsured:

Check with your agent to see if your state requires this kind of coverage or if it requires insurers to offer it. Pay special attention to this coverage in states like Florida and Washington which do not require minimum liability coverage.

Add-ons:

Common add-ons include:

- Trip interruption: Anyone who has been stranded far from home after a wreck knows the frustration. Trip interruption coverage could reimburse you for unplanned hotel and restaurant bills resulting from an extended stay after an accident more than 100 miles from home.

- Rental fees: Tired of bumming rides or taking the bus while your bike gets fixed? This kind of coverage reimburses you for rental car fees after a wreck.

- Roadside assistance: This kind of coverage offers an alternative to joining a motorcycle or auto club. Some plans include fixing a flat along with towing or, when possible, simple roadside repairs.

- Passenger coverage: This is an essential option for people who regularly ride in tandem.

- Trailer coverage: Some companies offer extra coverage for pull-behind trailers (but probably not their contents).

Additions like these offer convenience but they also raise your premiums.

Someone looking for the lowest premiums should pass on these unless you have a specific and regular need for the extra coverage.

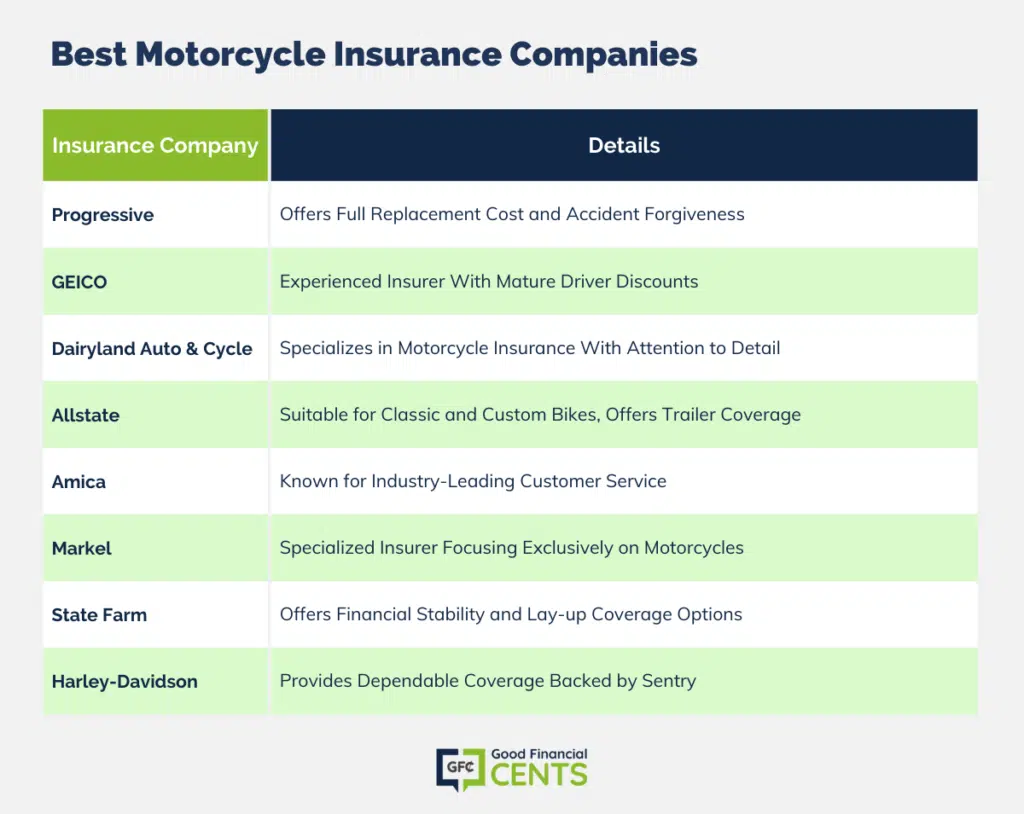

Top 8 Best Motorcycle Insurance Companies

Hundreds of insurance companies offer coverage, so finding the right one could take months when you’re working alone.

To make things easier, I’d like to share eight of my personal favorites. Every company on my list has earned high ratings from independent rating agencies, which means it should be a reliable partner down the road.

No list can include every solid insurance company, though. If another company has worked well for you and it has good ratings, stick with it.

When you’re looking for new coverage or trying to replace existing coverage, I think any of the companies below would be a great place to start if it offers coverage in your state:

Progressive

We all know about Progressive from the company’s ads, but how does it stack up to unbiased scrutiny?

Quite well. The 80+-year-old company offers an uncommon combination of strength, stability, and flexibility.

Standard benefits even include full replacement costs without depreciation which makes Progressive a great choice for classic bike owners.

Progressive is also less likely to hike up premiums after an accident because it offers a more nuanced than usual accident forgiveness program. For example, a claim of $500 or less should not affect your premiums.

GEICO

Here’s another nationally known insurer that more than holds its own when the rubber meets the road.

GEICO has been expanding its services and its name recognition for decades.

The company added motorcycle insurance to its stable in 1978, so it has four decades of experience partnering with bikers.

We especially like GEICO’s mature/responsible driver discount and its top ratings from both the independent rating agencies, which check on financial health, and the Better Business Bureau, which gauges customer satisfaction.

Dairyland Auto & Cycle Insurance

Like Amica, Dairyland Auto & Cycle Insurance may not have the biggest national advertising budget, but it offers solid coverage and has many satisfied customers.

Unlike most insurers, this Wisconsin-based company with more than six decades in the business focuses specifically on vehicles.

Because of this specialization, Dairyland can offer uncommon attention to detail. For example, you can insure personal belongings on your bike, specify the amount of coverage for a passenger, and get special discounts for membership in motorcycle associations.

Since Dairyland does not offer home, life, health, or other kinds of coverage, you won’t have as many opportunities to bundle coverage.

Allstate

Allstate, the well-known national insurance giant, rounds out our list of eight.

The company is large and stable and it has local agents across the country.

Like State Farm, the customer service you receive from Allstate may vary based on your local agency.

We recommend Allstate for motorcycle coverage because they offer great options for classic and custom bikes.

You can also add trailer coverage quickly and easily.

Amica

Amica has topped a lot of insurance lists lately, even though many people still haven’t heard of the Rhode Island-based company.

Amica is among the industry’s leaders in customer service, especially during the claims process.

Like any insurance company, Amica has customers who have shared negative feedback.

But remember, happy customers are much less likely to share their experiences, and the vast majority of Amica’s customers seem to be satisfied with their coverage and their ability to access it when needed.

Be sure to ask about discounts for the safety features of your bike.

Markel

If you’ve never owned a motorcycle, you probably haven’t heard of Markel. This Wisconsin-based insurer covers only motorcycles (and similar vehicles). It’s hard to get more specialized than that.

Like Dairyland, Markel’s specific focus allows for some extra focus on the details. For example, you can easily set your own coverage amount and see the resulting premiums based on a per-$1,000-in-value scale.

You’ll also get more specific information about what your policy covers: saddle bags (but not their contents), pegs, windshields, a trailer, your helmet, custom paint, etc. It’s great to know exactly where you stand when you need to file a claim.

These folks know motorcycles, from the handlebars to the pavement.

State Farm

We recommend State Farm mainly because of its financial stability. The nearly century-old insurer has a huge share of the insurance marketplace and top ratings from independent analysts.

It’s easy to find lay-up coverage with State Farm if you go months without riding. The company also has a niche when it comes to sidecar coverage.

Customer service can be a problem depending on your local agent, however. Overall, the Better Business Bureau has given State Farm a B+.

Before buying coverage, we recommend meeting your local State Farm agent and finding out for sure how responsive he or she would be if you filed a claim.

Harley-Davidson

Yes, that’s right.

The iconic bike company also insures motorcycles through its finance arm. And from what we can tell, you’d get solid and dependable coverage.

Backed by Sentry, which gets high marks from independent ratings experts, the coverage offers the basics and some extras, including coverage for restored or custom bikes.

Sometimes third-party underwriting can slow down claims, but Harley-Davidson seems to have found a way to make the process more seamless. The Better Business Bureau gives Harley-Davidson’s customer service staff an A+.

Coverage That Gives You the Freedom to Roam Free

Owning a motorcycle should give you freedom, power, and more individuality, right? Reading page after page of policy details can make you forget those lofty ideals.

But that’s just the thing:

Finding the right coverage is key to enjoying the freedom and independence a motorcycle promises.

With the right coverage in place, you can ride on without worrying so much about how you’d deal with the unexpected.

As you shop for coverage, remember these important questions:

- Are you getting enough coverage?

- Does your insurance company have quality financial ratings?

- Have you tapped into available discounts?

- Will your insurance company be accessible when you file a claim?

- Can you change your policy in the future if needed?

Making these decisions now can pave the way for a smoother ride no matter what you discover around the next curve.