I remember starting my career as a young adult, I had a lot on my plate, working my 9 to 5, paying off my student loans, and hoping to find my future spouse.

One of the last things on my mind was buying life insurance. I could almost guarantee that for all young adults buying life insurance is the last thing on our minds.

So the question remains, “Should young adults consider buying life insurance?”

The cop-out answer is: it depends.

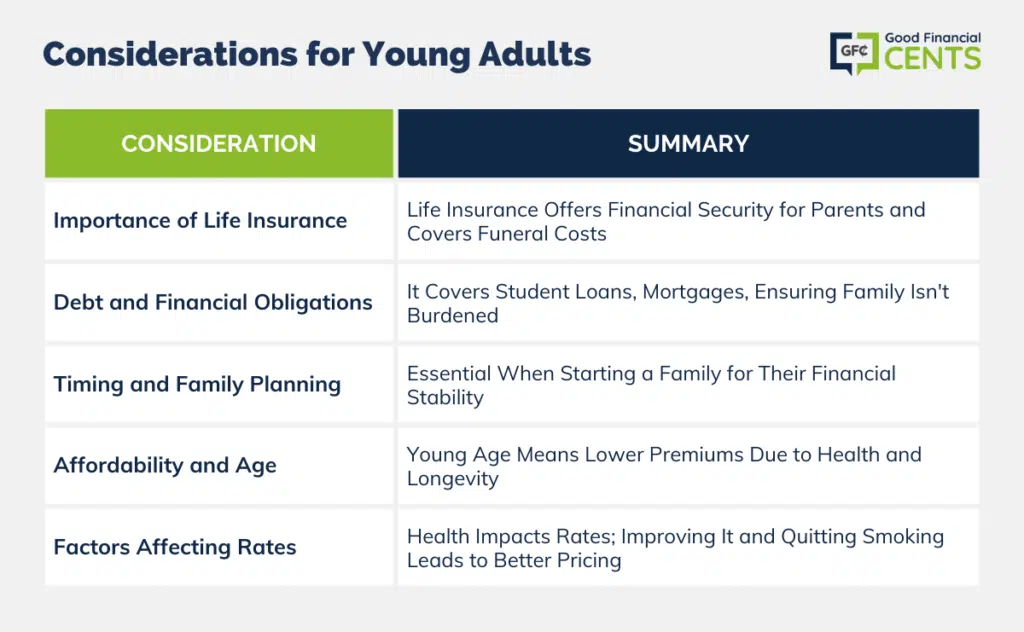

A lot depends on where you are in your life and where you plan to be in the next few years. If you are a young adult considering buying life insurance, here are some things to consider.

Table of Contents

Remember the Hand That Feeds You

In retrospect, I regret not buying life insurance when I was a young adult. Sure, I was single and I didn’t have any dependents, but my parents didn’t have a lot of income and a lot of financial stability.

If something happened to me and they had to pay for my funeral expenses, it would have affected them greatly.

In fact, it would have been so great that I honestly don’t know how they would paid for it. Getting a cheap term policy would have cost me less than $10/month and my parents would have been unscathed financially if something happened to me.

If you are single, you might not think that you need life insurance but don’t forget about the ones that raised you.

Life insurance is very inexpensive and even if you took out a small $50,000 to $100,000 policy, you would be paying less than 2 value meals at McDonald’s a month for coverage. It is the responsible thing to do and it won’t drain your checking account like one would think.

If you’re in the same boat that I was in, single with no dependents, you probably think the same thing I did, that life insurance would be a waste of time.

But before you automatically discount it, talk to your parents about the possibility of something tragic happening and what kind of financial suffering they would experience if you were to pass away.

What About Debts?

It seems nowadays that parents are helping their kids more and more get through school and get their careers started. I wasn’t one of those lucky ones, but my wife was.

Her parents sacrificed funding their retirement fully to pay for their daughter’s tuition and cost of living while at school. Imagine if something happened to her and now all that money on books and fees is literally flushed down the toilet.

If she would have had bought cheap life insurance, her parents would have replenished all the money they had invested into her college education.

But, just because you’re a young adult doesn’t mean that student loans are your only debt. This is the stage of life when you’re going to start looking to buy a house, right? Even if you don’t have a mortgage right now, look a few years into the future.

A couple of years down the road you could buy your first house, which means that you’re responsible for your first mortgage. If you were to pass away with that mortgage, guess where it’s going? Straight to your family.

When Shouldn’t Young Adults Buy Life Insurance?

If you are debt-free, your parents haven’t handed you the silver spoon and you are not married, then buying life insurance isn’t necessary. At least not yet. When you do start your family, that’s when life insurance should become a priority.

Also, don’t buy your life insurance through your employer (unless you have a pre-existing condition). The price is usually about the same as buying it through a third party, plus you won’t have to worry about getting life insurance again if you change jobs.

Life Insurance Is NOT Expensive

One of the major benefits of buying life insurance when you are young is that it is super, super cheap, as mentioned above. The younger you are, the lower your costs are going to be in paying for your life insurance.

Going from your 20’s to your 30’s or 40’s, you can generally see a 20% to 25% increase in premium.

Compound this with the fact that when you are younger, you are super healthy and probably still find time to work out five days a week, which further increases your chances of locking in a low rate.

Getting the Best Life Insurance Rates (When You’re Young)

Yes, as a young adult, life insurance is going to be cheap. Very cheap. But this is the premium that you’re going to be paying for many years to come, so you want to get the best rates that you can.

You have one of the biggest advantages of finding cheap life insurance, your age. Your age is the biggest factor in determining how much you’re going to pay for your coverage, buying coverage at 20 is much more affordable than purchasing life insurance over 50 years old, but it’s not the only one.

You can’t do anything about how old you are (trust me, you can’t stop it), but there are some factors that you can change and save money on your insurance plan.

The next biggest factor that the insurance company is going to look at is your health. They will look for any pre-existing conditions and your overall health to determine how much of a risk you are.

The higher your risk level may be, the more they’re going to charge you for insurance coverage. If you want to save money on your monthly premiums, spend a couple of months improving your health.

After you complete the initial paperwork for your policy, the insurance company is going to send a paramedic out to complete a simple medical exam to determine what kind of health you are in.

During this exam, the paramedic is going to take your blood pressure, and cholesterol, take a blood sample, and also a urine sample. These results are going to play a role in what kind of ratings you get.

If you have are carrying a few more pounds than you should, it’s time to trim down that waistline. Being overweight increases your chances of having health problems later in life, like diabetes or heart complications. It’s time to actually use that gym membership that you’ve been paying for.

Additionally, if you’re a smoker or tobacco user, it’s time to kick those bad habits once and for all. If you’re listed as a smoker on your life insurance application, you’re going to be looking at double or triple the monthly premiums of a non-smoker.

Sure, that could only raise your premiums by $20 or $30, but once you calculate that out through the course of the insurance policy, it adds to some serious cash.

Bottom Line – Getting Life Insurance When You’re Young February 2025

The best way to ensure that you get the best rates is by comparing dozens of companies before you choose the plan that works best for you.

Each company is different and is going to view your applications differently.

It’s vital that you receive quotes from several different companies before you choose the one that works best for you.