Term life insurance is an important investment that can protect your family’s assets at any stage of your life, and getting affordable life insurance rates is important for protecting your budget right now.

Your age, though, will also determine how much you need, how long you need it for, and if the term or a guaranteed policy is the best.

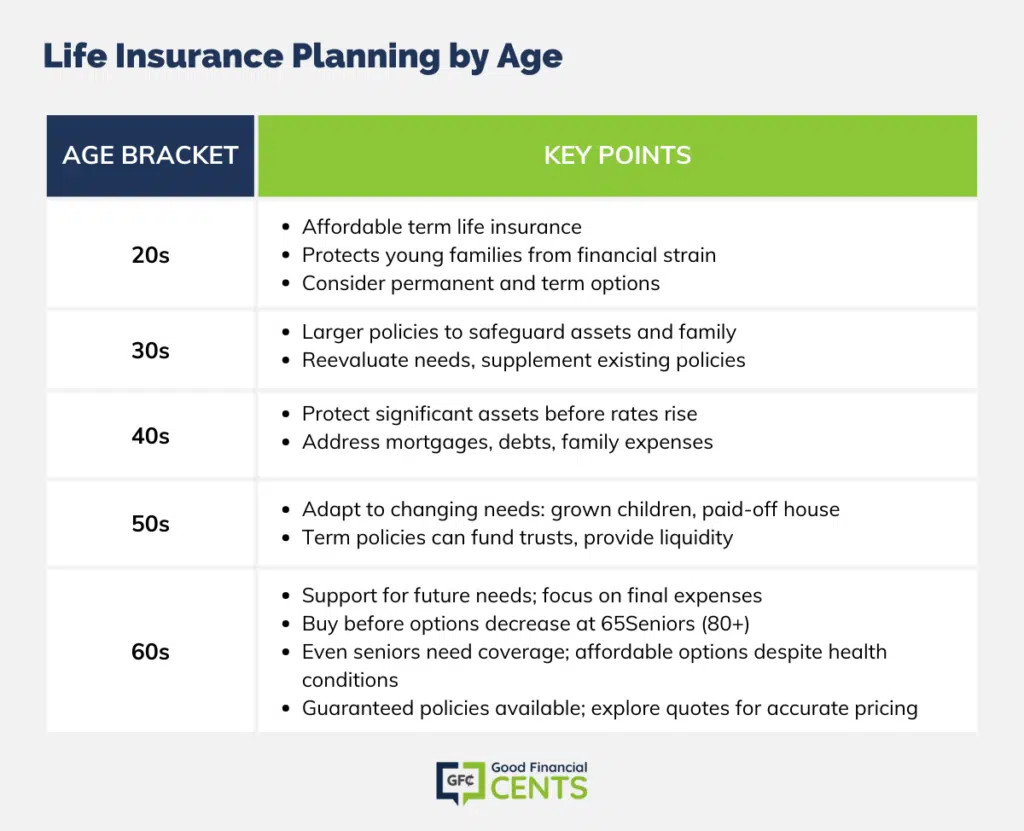

Below is a quick guide on the different ages and what you should consider when buying life insurance. I’ve also included links to relative articles that go more in-depth on each age bracket.

Here’s what you need to know to get cheap life insurance at any age.

Whether you are single or married, a part of a large family or a small one, purchasing insurance is a responsible step that everyone should take so that loved ones will be provided for.

Table of Contents

5 Things to Know Before Shopping for Life Insurance Rates

1. Know your family’s budget and how the life insurance rates will fit within your budget. Knowing this dollar amount will keep you from being “oversold” by an agent trying to earn higher commissions. The premiums must fit within your budget.

2. Be aware that each person’s life insurance needs for death benefit amounts are different. We will look at this in more detail later, but just because your buddy or co-worker bought a million-dollar life insurance policy doesn’t mean that you need to.

3. Understand that life insurance companies have different underwriting guidelines and that you HAVE to compare rates from different companies to be confident you’re getting the lowest life insurance rates available for you based on your lifestyle, your medical conditions, and your age. (We compare rates from different companies for you.)

4. Be thinking about the following numbers (to help determine the death benefit needed):

- How much family debt do you have (mortgages, credit cards, autos, etc.)

- College education dollars needed for children in the household

- Ongoing income dollars for a surviving spouse (if applicable)

- Estimated amounts of funeral costs

- Any philanthropic dollars you might wish to leave to a favorite charity

- How much life insurance do you have now, for how long (i.e., 20-year term), and is it a permanent policy like whole life or universal life

5. This is related to #3. It might not be in your best interests to buy life insurance from agents that only represent one company and can’t offer you quotes from several different companies. Some of these life insurance companies are Northwestern Mutual, New York Life, and others that have agents that only sell their life insurance plans.

Understanding Life Insurance Rates by Age

Purchasing life insurance is very important, and generally speaking, one of the main factors in pricing life insurance from the insurance company’s viewpoint is how old you are.

Your age will help you determine how much death benefit you need to apply for, how long you need it for, and whether a term or a guaranteed policy is the best plan that suits your needs.

Obviously, it just makes common sense that the older you are, the less number of years you are expected to live.

Life insurance companies call these “mortality tables”, and they use these mortality tables to actuarially determine how much they should charge for life insurance.

These CSO mortality tables have been adopted by most state insurance departments to allow companies to use them in determining the premiums they should be charging for their life insurance policies.

Remember, though, that even these life expectancy charts are used differently by different life insurance companies.

We can provide you with several life insurance company reviews, such as Banner Life Insurance, for you to learn more about what each company has to offer, so make sure to check those out as well!

Critical Reasons to Prioritize Life Insurance

Many people put off buying life insurance because it doesn’t seem to be an immediate need or priority to fit into the family budget. Here are 3 critical reasons to apply for life insurance now and not put it off any longer:

- You really aren’t getting younger. As just mentioned above, as you get older, your rates are going to increase. The best day to buy life insurance is today.

- If you don’t have any major health conditions that would cause your life insurance rates to be surcharged, get your life insurance now while you are in good health. If you do have medical conditions, get your life insurance now before your health gets worse. If it improves later, then you can always reapply for lower rates.

- You never know what the future holds. Take care of your loved ones now, and go ahead and check “buying life insurance” off your list. Whether you end up getting quotes from us (Compare Rates form on the right) or from someone else, go ahead and do it.

Now, let’s discuss issues based on various ages. We will first start with the Millennials……

Life Insurance for Your 20s

In your 20s, life insurance is inexpensive and easy to get. At this age, you can expect an enormous number of term life options at affordable prices. By getting life insurance at this early stage, you can protect a young and growing family from financial hardships and do so inexpensively.

Going ahead and buying life insurance now is a great decision to make at this young age. It is better than waiting until you are older, possibly having health issues, and having to look into the option of life insurance without a medical exam, which defaults to a higher rate because of the poor health you may have at older ages. Starting young and healthy is the way to go!

Depending on your income and family budget, you could consider both permanent life insurance and inexpensive term life insurance.

If you don’t have children or large assets to protect, choose a policy of at least four times your annual income. If you do have children, the number of children, your spouse’s income, and your other debts should all factor into the amount of insurance you purchase.

Read more on buying Term Life Insurance in Your 20s.

Life Insurance for Your 30s

In your 30s, you likely have a family and assets that need to be protected with a life insurance policy. Your income may be higher during this period, necessitating a larger policy to meet bigger financial needs. Some life insurance buyers purchase a second policy in their 30s to supplement the policy bought in their 20s.

If this is your first time to purchase term life insurance, be sure to get enough to cover your family’s needs and to pay off your home and other large debts. A general rule is to purchase at least 10 times your annual income, and in your 30s, this is generally an affordable option.

This amount of death benefit may seem to be higher than what you would normally consider; however, if you lose one of your family incomes due to death, there would be a huge financial pressure to try and make up the difference, or either the surviving spouse would have to drastically reduce expenses.

The mortgage still needs to be paid, most kids still need to go to college, there would be funeral expenses, etc. Speaking of mortgages, we typically do not recommend buying mortgage life insurance from the letters you get in the mail from life insurance companies just after you have refinanced your house, for example.

During these years, it would also be a good time to consider a permanent life insurance policy, which begins to build some cash value. This would be a good discussion question for your life insurance advisor.

Read more here:

Life Insurance for Your 40s

By your 40s, you likely have significant assets to protect. If you have not bought a life insurance policy yet, it’s important to do so before the rates rise even more in your 50s or future health conditions, such as diabetes, make it more difficult to get insurance.

Financial experts agree that even if you already have a policy in place, your 40s is a good time to sit down with your finances and reevaluate your insurance needs. You may find that you need a supplemental policy to take care of new responsibilities that weren’t present in your 30s.

With today’s economy and lifestyles (increase in divorce rates), many individuals and families are still deep in debt. This is not a time to be slack in taking care of potential financial disasters (such as the loss of a spouse and their income), but rather a time to take care of life insurance needs.

Read more on buying Term Life Insurance in Your 40s.

Life Insurance for Your 50s

As you enter your 50s, you will have different insurance needs than you did in years past. You may have grown children who can provide for themselves. Your house may be paid off, and you may need to cancel that mortgage insurance policy if you have one.

However, there are still many expenses that a term life policy can assist your family with paying. A term policy can be used to fund a trust, to provide your family with inheritance, and to provide a liquid asset for your estate.

Life insurance will be more expensive at this age, and that expense will go up if you have significant health problems. However, even at the increased rates, term life insurance is still an affordable insurance option.

You may find yourself at this point either experiencing or have experienced the loss of a parent or loved one, and personally now understand the financial aspects of that event, whether good or bad.

If you have experienced that situation, you will have found out that life insurance proceeds are handled outside Probate Court and are much easier to deal with than all the other legal issues of handling someone’s estate.

One other important issue to consider during this stage of life is if you might have some type of business life insurance need. This could be from a Key Man life insurance standpoint or maybe life insurance to fund a Buy-Sell contract between partners that own a business. Additionally, if you are a Sole Proprietor who owns a business, you might want to have a one-way buy-sell arrangement with a friendly competitor.

Life insurance rates for business policies may generally be lower per thousand dollars of death benefit because, usually, these types of plans have higher death benefits. Companies usually have “life insurance rate bands,” and there are discounts as the death benefits get higher.

Any of the above business life insurance needs are very critical and can also help a surviving spouse if you have some type of “business will”. The death of a spouse is a traumatic event, even if expected, so minimize the additional responsibilities that a person may have to deal with as much as possible by prior planning.

Read More on Buying:

- Term Life Insurance in Your 50s

- Life Insurance At Age 51

- Life Insurance At Age 52

- Life Insurance At Age 53

- Life Insurance At Age 54

- Life Insurance At Age 55

- Life Insurance At Age 56

- Life Insurance At Age 57

- Life Insurance At Age 58

- Life Insurance At Age 59

Life Insurance for Your 60s

In your 60s, you may not have dependents who need your income, but term life insurance can still provide a level of support for your loved ones in the future. If you don’t have enough death benefit coverage by the time you reach your 60s, purchasing a policy as soon as possible is vital.

Hopefully, during these years, most of your debt is reduced to a manageable level, college debts for your kids have been taken care of, and your main need for life insurance will be to help pay for final burial expenses, ongoing income to supplement social security benefits for a surviving spouse, as well as to provide a charitable gift for a local nonprofit you might be actively involved in.

If you wait until age 65, you will have far fewer insurance options. Some companies simply won’t sell a policy to anyone 65 or older. At this stage of life, you can expect rates to be more expensive, but they will still cost significantly less than whole-life policies.

Read More on Buying:

- Life Insurance At Age 61

- Life Insurance At Age 62

- Life Insurance At Age 63

- Life Insurance At Age 64

- Life Insurance At Age 65

- Life Insurance At Age 66

- Life Insurance At Age 67

- Life Insurance At Age 68

Affordable Life Insurance Rates for Seniors

Even seniors age 80 need life insurance coverage. With advances in medicine and healthcare facilities, people are living much longer. Some of the needs for life insurance for seniors are the same as those mentioned for folks in their 60s.

Rates for life insurance for seniors do not have to bust your budget, however. It’s still possible to get affordable life insurance as a senior citizen.

Many times there are medical issues that cause life insurance rates to be higher than they are for those without medical conditions.

However, even with medical conditions, there are many good guaranteed life insurance policies for the elderly.

If you’re ready to see real pricing, get a life insurance quote now.

The Bottom Line – Life Insurance Rates by Age

Navigating the realm of life insurance can be overwhelming, but understanding the impact of age on policy choices and premiums simplifies the process. Age is a pivotal factor, influencing not only the cost but also the type of coverage that aligns with individual needs.

From the vibrancy of one’s 20s to the golden years extending into the 80s, there’s a tailored insurance solution for every stage. Even amidst health challenges and changing financial circumstances, affordable and beneficial options remain accessible.

Assessing your personal financial landscape, familial obligations, and long-term aspirations is essential. Remember, there’s no better time to secure your family’s future than the present.

your form is flawed wont axcept birth date 10/07/1947 dont want phone call email only