One of the trends that became popular during the housing market boom was relying on home equity to pay for unexpected expenses. The idea is that you can use a home equity line of credit (HELOC) to cover emergencies.

However, even in the good economic times, this was probably a dubious strategy for short-term savings. Now, with credit tighter than it has been in years, using a HELOC for short-term savings can be even more of a danger.

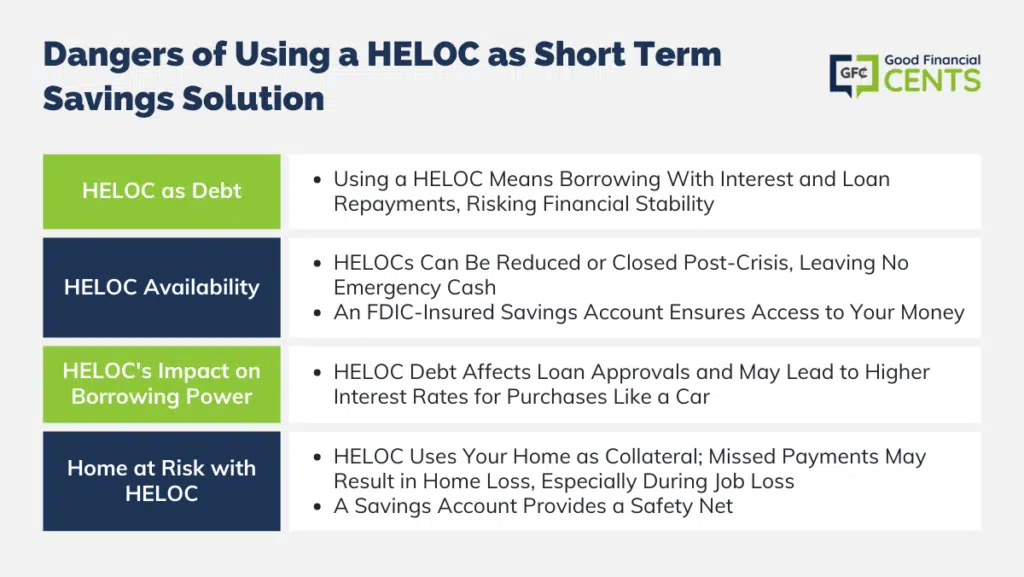

Here are some of the reasons to think twice before you use your HELOC as a source for short-term savings:

Table of Contents

Your HELOC Is Debt

The first issue with using a HELOC for short-term savings is that it is debt. You are borrowing money. This means that you are paying interest, and you will have to eventually make payments on the loan. Piling on more debt to deal with an emergency is rarely a formula for financial stability.

Instead, you are likely better off saving up in a high-yield account that can provide you with liquid cash. Even if you are getting a tax deduction for the interest paid on your HELOC, it might not be enough to offset the other costs that can come with increased debt.

HELOC Might Not Always Be There

Since the financial crisis and credit crunch, many are finding that their HELOCs are being closed out, or the available credit is being cut. This means that if you are relying on your credit to be there in an emergency situation, you might be disappointed.

You might find yourself with no available cash, and no HELOC to tap. With an emergency savings account, you at least have the cash, and, as long as it is in an FDIC-insured institution, you won’t lose it.

HELOC Can Reduce Your Borrowing Power

You should also realize that a home equity line of credit isn’t the same as having liquid cash in an emergency savings account.

So, if you go to buy a car, or make some other large purchase that requires you to apply for a loan, your HELOC could count against you, and prevent you from making that purchase — or result in a higher interest rate if you are approved.

Your Home Is at Risk With a HELOC

When you have a HELOC, you are securing the loan with your home. If something happens, and you can’t make payments, then you could lose your home.

This can be especially troublesome if you have lost your job since your lack of income and ability to make HELOC payments can mean foreclosure.

It is true that your home could be in danger with a job loss, even without a HELOC, but it is often easier to find a solution for one loan than it is for two.

Plus, if you have saved up several months of expenses in a high-yield emergency savings account, then you can get by for a while before you have to worry about foreclosure.

Bottom Line

A HELOC represents more debt and is rarely a good idea when it comes to short-term savings. And, because the bank can change the terms, and cut your credit line, it might not be a reliable source of emergency money.

You are probably better off putting an emergency fund in a high-yield savings account.

**This is a guest post Miranda Marquit is a journalistically trained freelance writer and professional blogger working from home. She is a contributor for Mainstreet.com, Personal Dividends, and several other sites. Miranda is not affiliated with or endorsed by LPL Financial.