NOTE: In June 2023, Savebetter by Raisin rebranded to simply Raisin for better brand awareness

If this past year has taught us anything, it’s that investments that seem too good to be true almost always are. Many investors were burned by ‘can’t miss’ tech stocks and could only watch as the value of digital assets, like cryptocurrencies and NFTs, evaporated in minutes and couldn’t sustain the promised high returns.

In a highly volatile market, deciding how to invest your money is as challenging as ever, which is why rising interest rates have led many investors toward the safety of savings accounts and Certificates of Deposit (CDs).

This is where SaveBetter comes in.

SaveBetter pools high-interest savings accounts and CDs from financial institutions nationwide, giving customers access to high-yield accounts they otherwise wouldn’t know about.

But is SaveBetter (Raisin) the best way to secure the best savings rates? I’ll answer that question and more in this review.

Table of Contents

What Is SaveBetter (Raisin)?

SaveBetter (Raisin) is a financial technology company founded in late 2020 as a subsidiary of Deposit Solutions, now Raisin DS. Raisin works with over 400 banks in more than 30 countries worldwide.

What makes SaveBetter unique is that it’s a digital platform, not a traditional bank. SaveBetter claims to provide a digital “storefront” for banks and credit unions looking to promote deposit products to a larger audience.

Because the SaveBetter platform promotes products from lesser-known financial institutions, investors can take advantage of offers they may not have had access to otherwise.

Customers can choose between savings products from FDIC-protected banks and NCUA-insured credit unions that offer superior interest rates.

5.26%

Interest Rate

varies

Min. Initial Deposit

Key Features

| Account types | Savings accounts, Money market accounts, CD accounts, No-penalty CDs |

| Fees | None |

| Deposit Insurance | Yes |

| Customer Service Options | Email, phone |

| Customer Service Phone Number | 844-994-EARN (3276) |

| Web/Desktop Access | Yes |

| Mobile App Availability | No |

SaveBetter (Raisin) Products

With SaveBetter (Raisin), you can easily locate savings products from several financial institutions to ensure you’re earning the best possible yield.

You can also access your savings accounts and investments under one dashboard, For example, you could have a two-year fixed-term CD for your wedding savings and a high-yield savings account for your emergency fund, and view them both on the same dashboard.

High-Yield Savings Account. A traditional savings account with no limits on deposits and withdrawals. Allows you to earn a higher interest rate while having constant access to funds when you need it.

Money Market Deposit Account (MMDA). A money market account is a type of savings account at a bank or credit union that lets you earn interest on your money and make withdrawals.

No Penalty CD. Lock in an attractive rate for a set period with the ability to make a complete withdrawal at any point after the first seven calendar days of funding your account without paying the penalty. CD yields are usually higher than savings accounts.

Fixed-Term CD. Your money is held for a fixed period with a competitive APY that allows a predictable and safe return on your money. Fixed-term CDs offer higher rates than savings accounts and no-penalty CDs, but your money is locked in for the duration of the term, i.e., 1 Year, 3 Years, or 5 Years.

Is SaveBetter (Raisin) Legit?

SaveBetter is a legit way to invest. Even though SaveBetter isn’t a bank, your deposits with them are protected up to $250,000 with FDIC protection for bank products and NCUA coverage for credit union products.

SaveBetter is also a SOC 2-certified platform, and they use other security protocols, including multi-factor authentication, encryption, and advanced internet protection from Cloudflare.

While there aren’t as many SaveBetter Reviews online as you would find with more established banks, it’s likely that the service just hasn’t been around for long enough.

How to Get Started With SaveBetter (Raisin)

Here’s how you can get started with SaveBetter:

Step 1: Create your account.

Set up an account with your unique username and password in 3-5 minutes. It will ask you for the same information required when signing up for any kind of financial product.

Step 2: Review the different investment options.

Once your account has been activated, it’s time to review the various investment offers on the main page. You can choose between high-yield savings accounts, fixed-term CDs, and no-penalty CDs. You’ll notice a wide range of products from different financial institutions, so you can shop around until you find the most attractive offer for your situation. You can also explore these options before creating your account.

Step 3: Apply for offers.

You can apply for any FDIC-insured product listed on the platform. SaveBetter also lets you mix and match when it comes to the different institutions and offerings available. For example, you can invest in a high-yield saving account with Third Coast Bank and a fixed-term CD offered through Ponce Bank.

Step 4: Fund your account.

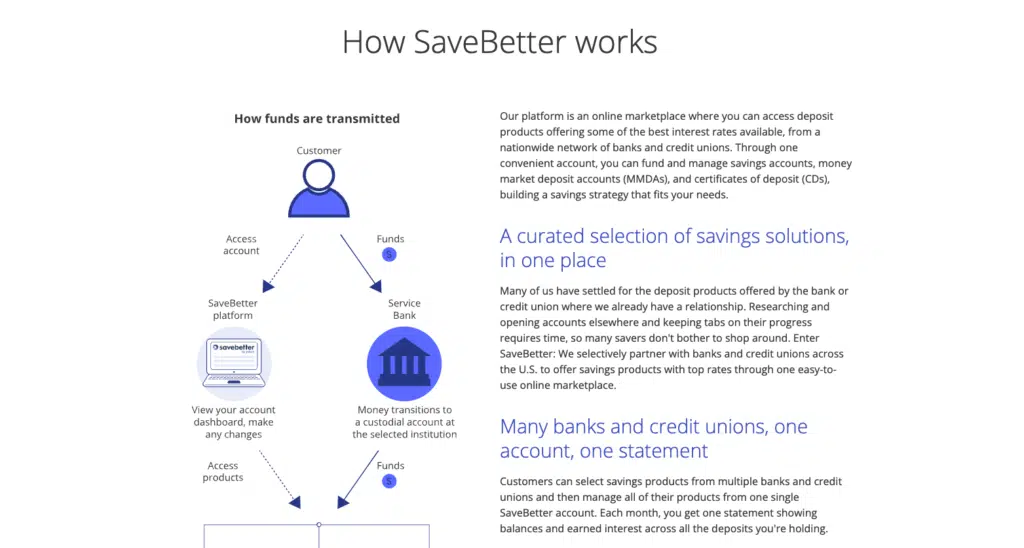

Once you’re ready to purchase an investment based on your financial goals and liquidity preferences, you will fund your account by connecting an existing checking or savings account through Yodlee (a third-party app), or manually inputting your routing and account number for your current banking setup.

From there, it takes about three business days for the transfer to go through. You’ll start accumulating interest on your money when the transfer hits your SaveBetter account.

Step 5: Manage your different investing accounts under one dashboard.

With SaveBetter, you can manage all of your accounts under a single dashboard. For added simplicity, you’ll only get one tax document from SaveBetter, even if you invest with multiple financial institutions.

SaveBetter (Raisin) Alternatives

As an online marketplace dedicated to savings products, SaveBetter is unique and has no direct competitor. That said, other online banks are offering attractive rates on high-interest savings accounts and CDs. Here are a couple of SaveBetter alternatives worth considering.

Ally Bank

Ally is an online-only bank that also offers high-yield savings accounts and CDs. With a 4.25% APY at the time of this writing, their savings account is slightly lower than what you can find with SaveBetter (Raisin). Still, it offers numerous features you won’t find elsewhere, like recurring transfers and savings buckets.

You also don’t have to worry about a minimum balance or maintenance fees with an Ally Bank savings account. However, if you’re looking for the highest return for your money, SaveBetter (Raisin) rates are higher.

SoFi

SoFi is an online personal finance company and a bank that allows you to complete your financial transactions in one place. You can have a checking account, savings account, credit card, credit score tracking services, and various other financial products under one umbrella.

SoFi is currently offering a savings account with a 4.50% APY. You can do all your banking in one place, and you’re guaranteed to earn interest on your money. With over four million users, it’s clear SoFi has become a one-stop shop for personal finance for many folks.

5.26%

Interest Rate

varies

Min. Initial Deposit

SaveBetter Review: Final Thoughts

If you’re looking for a place to park your money in the short term, you should be checking out SaveBetter’s offers. At the very least, review the products to see if you can find a suitable product that meets your needs. Savings accounts don’t offer the return potential of long-term market investments, but you’ll sleep well at night knowing your money’s safe.

Even though SaveBetter isn’t as established as some of the big national banks, and they work with smaller financial institutions, know that your money will be protected with deposit insurance while you earn a decent return.

SaveBetter (Raisin) FAQs

Since SaveBetter (Raisin) only launched in 2020, many investors still aren’t familiar with the company. Here are the answers to some common questions people have about SaveBetter.

Yes. SaveBetter (Raisin) connects you with trusted financial institutions. All of the deposits on the platform are held at institutions that are federally insured.

SaveBetter (Raisin) currently doesn’t charge customers any fees for using the platform. You can start investing with as little as $1 without worrying about any hidden fees you typically find with a banking account.

SaveBetter (Raisin) generates revenue by charging financial institutions to market products to the platform’s customers. By charging the banks and credit unions, SaveBetter can offer customers free services and higher rates.

When marketing to reach new customers, smaller, lesser-known financial institutions simply don’t have the financial resources to compete with the more established banks. To attract new customers nationwide, these banks and credit unions offer higher interest rates to entice new customers to enroll.

When you move your funds from your external banking account, the funds go from the bank account to a custodial account with the institution offering the savings product. A federally insured banking institution or credit union always holds your money.

While you do have to join a credit union to use its products, SaveBetter (Raisin) ensures that the process is quick, easy, and free. This means that SaveBetter customers can invest with a credit union without paying any membership enrollment fees. You will always access the financial product through the SaveBetter platform.

SaveBetter (Raisin) works with a variety of banks and credit unions. Some of the banks and credit unions include:

– Ponce Bank

– Great Lakes Credit Union

– Idabel National Bank

– American First Credit Union

– Lemmata Savings Bank

– SkyOne Federal Credit Union

– Sallie Mae Bank

– mph.bank

You can find a list of banks and credit unions and their products on the SaveBetter (Raisin) Explore page.

You can contact the SaveBetter customer service team Monday to Friday between 9 a.m. and 4 p.m. EST. Their telephone number is (844-994-EARN). You can also send an email to [email protected].

How We Review Banking or Financial Institutions:

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Raisin Review

Product Name: Raisin

Product Description: Raisin is an innovative online savings and investment platform that provides users access to competitive interest rates across a variety of European banks. It streamlines the process of creating and managing savings accounts, making it easier for users to optimize their returns without the hassle of navigating through different banking portals. The platform emphasizes transparency, user-friendliness, and providing a diverse range of savings products.

Summary of Raisin

Raisin distinguishes itself by consolidating a wide range of savings and investment products from different European banks onto one accessible platform. Users can effortlessly compare interest rates, terms, and conditions to find the most suitable savings options. The platform also simplifies the account creation process, enabling customers to open and manage multiple savings accounts across different banks without additional paperwork for each new account. Raisin’s commitment to providing a user-friendly experience is evident through its straightforward interface and responsive customer support. While it opens up opportunities for higher returns on savings, the platform primarily features products from European banks, which might be a limitation for users interested in global investment opportunities.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- You can open an account in 3-5 minutes.

- Access investments from multiple financial institutions.

- Manage all of your accounts from a single dashboard.

- Simplified tax reporting with a single 1099-INT document.

Cons

- You may be investing with less established FIs.

- No online bill pay or checking services available.

- Limited customer service is only available between 9 AM and 4 PM EST.