Update: As of 2024, Sprout Life Insurance is no longer in business.

The vast majority of Americans need life insurance. But with so many different insurance policies and providers, how can you find the right life insurance policy for you and your family?

Sproutt Insurance is trying to help by putting a unique spin on the insurance application process.

Sproutt doesn’t sell its own insurance policies – they’re an online marketplace that uses technology to match you with the right insurance provider. In minutes, you can complete a brief application and get a quote from one of their participating life insurance companies.

But is dealing with Sproutt as easy as they make it sound? And is there a benefit to dealing with a marketplace like Sproutt versus going through an individual provider?

I’ll cover this and more in this Sproutt Life Insurance Review.

Table of Contents

- What Is Sproutt?

- How Sproutt Works

- Key Features

- Sproutt Life Insurance Quality of Life Index

- Who Is Sproutt Life Insurance Best Suited For?

- Types of Insurance Offered by Sproutt Life Insurance

- Is Sproutt Life Insurance Legit?

- How Do Customers Rate Sproutt?

- Sproutt Life Alternatives

- How to Use Sproutt to Shop for Life Insurance

- How to Save Money on Life Insurance

- Sproutt Life Insurance Review: Final Thoughts

What Is Sproutt?

Sproutt is an insurance fintech launched in 2018 under the name, Aktibo. They have their headquarters in Hartford, Connecticut, with offices in New York City and Tel Aviv.

Sproutt Life isn’t a direct provider of life insurance but a broker providing an AI-powered online life insurance marketplace.

They offer policies from nearly a dozen insurance companies, a list that includes some of the best-known brands in the industry. Sproutt is available to customers in all 50 states and the District of Columbia.

How Sproutt Works

Sproutt differs from traditional life insurers by using an AI-powered Quality of Life Index (QLI) to assess an individual’s healthy lifestyle behaviors rather than focusing on negative elements.

According to Sproutt, there are “huge inefficiencies” in the industry when using traditional data collection for accurate pricing and product offerings.

Sproutt says their self-serve digital process usually requires no medical exam, phone calls, or appointments to obtain life insurance coverage.

Sproutt is free to use, and the company provides live customer support. They have an A+ rating with the Better Business Bureau.

Key Features

- AI-powered online life insurance marketplace.

- Work with almost a dozen insurance companies across all 50 states.

- Quality of Life Index (QLI)takes into account your overall health.

- The QLI matches you with an insurance provider and policy that will be the best overall fit.

- Complete an application within 15 minutes.

- Customer support is available during business hours.

Sproutt Life Insurance Quality of Life Index

The QLI index is at the heart of Sproutt Life Insurance and the key to using their website.

The index uses an algorithm to assess your lifestyle and then provides a personalized set of suggestions, recommendations, and references based on the latest health information available.

The algorithm is called the Guided Artificial Intelligence Assessment (GAIA). To benefit from the index, you’ll need to complete a 15-minute assessment, a process I will cover in more detail further down.

The Index measures five areas of your life – referred to as pillars – to indicate your overall state of health and well-being:

- Movement. In a nutshell, this category assesses the amount of exercise you get.

- Sleep. Used to measure if you are getting an adequate amount of sleep.

- Emotional health. There’s growing evidence of a connection between strong relationships and longevity.

- Nutrition. This category is all about food and diet.

- Balance. It incorporates the other four pillars and also adds an evaluation of your sense of purpose in your life.

Once you’ve completed the QLI Assessment, Sproutt will match you with the best insurance company to fit your profile. This is expected to maximize the likelihood of approval, along with the most favorable premium rate.

Who Is Sproutt Life Insurance Best Suited For?

Sproutt Life Insurance is an excellent choice for applicants who are:

- Under 50 in good or excellent health (they go to age 60).

- In good or excellent health.

- Actively focused on maintaining their health, as determined by the Quality of Life Index Assessment.

- Looking for term life insurance versus whole life.

- Need a life insurance policy quickly.

- Prefer the speed and convenience of an all-online application process.

Obtain a Quote from Sproutt Today

Types of Insurance Offered by Sproutt Life Insurance

According to their website, Sproutt offers no-exam life insurance, guaranteed issue life insurance, whole life insurance, critical illness insurance, and universal life insurance – all in addition to term life insurance.

Sproutt’s term life insurance offerings range from 10 years to 3 years. The minimum policy amount is $50,000 but can go as high as $3 million. All other details of the term policies offered are based on the guidelines of the individual insurance companies providing the policies.

As an online life insurance “fintech,” Sproutt undoubtedly targets younger applicants (at least under 60) and in good or excellent health. Though they do offer policies for those who are in less-than-perfect health, it is possible that your application will be denied.

Is Sproutt Life Insurance Legit?

As mentioned, Sproutt has a Better Business Bureau rating of A+ (on a scale of A+ to F). although it is not BBB-accredited.

Though we typically obtain the financial strength rating of insurance companies from A.M. Best, this rating is not available for Sproutt. The company is an online insurance broker and not a direct provider. A.M. Best does not provide financial strength ratings for insurance brokers.

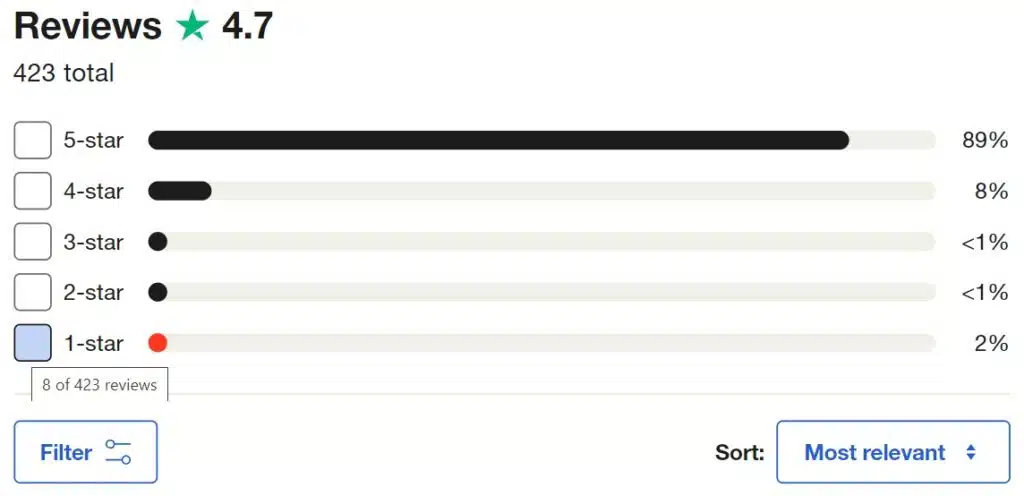

How Do Customers Rate Sproutt?

Sproutt scores 4.7 out of five stars with Trustpilot. The score is based on 423 reviews, with 89% ranking the company as “excellent” and 8% as “great.”

While the negative reviews were minimal (only 2% 1-star), I did review the comments to see if I could identify recurring themes. Most of the negative reviews were due to a lack of responsiveness and reps not getting back to the clients promptly.

One thing to note, the Sproutt team had responded on Trustpilot to almost all of the negative comments with a promise to follow up.

We could not obtain user ratings from Google Play or The App Store since Sproutt does not have a mobile app.

Sproutt Life Alternatives

When purchasing life insurance, always obtain quotes from multiple companies before making your choice. Even though the products are generally very similar, premiums between different providers can vary considerably.

For a quick comparison to Sproutt Life, I’ve included three companies – Fabric Life, Bestow, Haven Life, and Ladder– in a side-by-side comparison.

| Company / Feature | Sproutt | Fabric by Gerber Life | Bestow | Haven Life | Ladder |

|---|---|---|---|---|---|

| Available Policies | Term Life Insurance, 10 – 30 Years; Limited Whole Life availability | Term Life Insurance, 10 – 30 Years; Accidental Death Insurance | Term Life Insurance, 10 – 30 Years | Term Life Insurance, 10 – 30 Years | Term Life Insurance, 10-30 Years |

| Coverage Amounts | $50,000 to $3 million | $100,000 to $5 million | $50,000 to $1.5 million | $100,000 to $3 million | $100,000 to $8 million |

| Medical Exam Required | Varies by Provider | Not Always | Yes | Not Always | No exam for coverage up to $3 million |

| Age Range to Apply | Varies by provider | 21 – 60 | 18 – 60 | Up to Age 64 | 20-60 |

| Money Back Guarantee | Varies by provider up to age 60 | Yes | Yes | No | Yes – 30 days |

As you can see from the table, the products offered by each of the four companies closely match one another. One advantage Sproutt Life has is that it is an online life insurance marketplace.

With a single application, you can get quotes from multiple providers – including some of the biggest in the industry.

How to Use Sproutt to Shop for Life Insurance

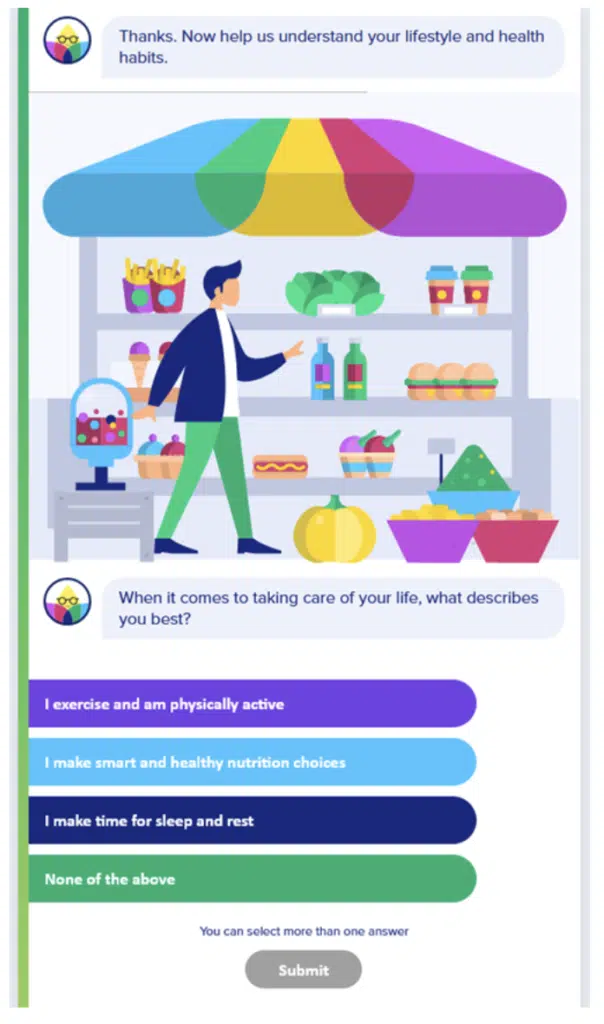

The application process for Sproutt starts with completing the Quality of Life assessment. It will take about 15 minutes to complete the assessment online.

That process can be accessed from the Quality of Life page, where you can click the green bubble that says “Check your QL Index.”

You’ll be asked to provide the following: your name (you’ll only need to provide your first name), age bracket, gender, and marital status.

Once you provide that information, you’ll be asked the following questions:

- When it comes to taking care of your life, what describes you best? The answers are multiple-choice and will appear as follows:

- Please select your choice of a healthy breakfast.

- For a healthier meal, you should…

- Which of the following is true regarding a sufficient intake of protein:

- Should I eat whole grains?

- To maintain a healthy weight, should I reduce my caloric intake?

- How many hours of physical activity do you do during a normal week?

- What type of activities do you do? (Aga n, you’ll be supplied with a list to choose from.)

- Do you track your physical activities?

- Over the past week, on average, how many steps per day did you take? (determined by a device, like a Fitbit.)

- Do you know how many hours an adult should sleep at night?

- How many hours do you sleep on average?

- Do you use a sleep-tracking device?

- Do you know in which sleep phases the majority of dreams occur?

- Do you know what a circadian rhythm is?

- Do you have trouble falling asleep?

- Do you consume alcoholic beverages to help you fall asleep?

- Do you own a pet?

- Do you sometimes feel that your relationships are not meaningful?

- How many people in your life can you confide in?

- Do you feel hopeless, stressed, or depressed?

- Have you tried stress-reducing techniques such as breathing, meditation, etc.?

- As I get older, things are… much better, somewhat better, same, worse, much worse.

- Do you believe you’ll live past… 60, 70, 80, 90, 120.

Once you’ve completed the questions, the following screen will appear, requiring you to enter your email and submit (the results are blurred, pending receipt of the emailed version):

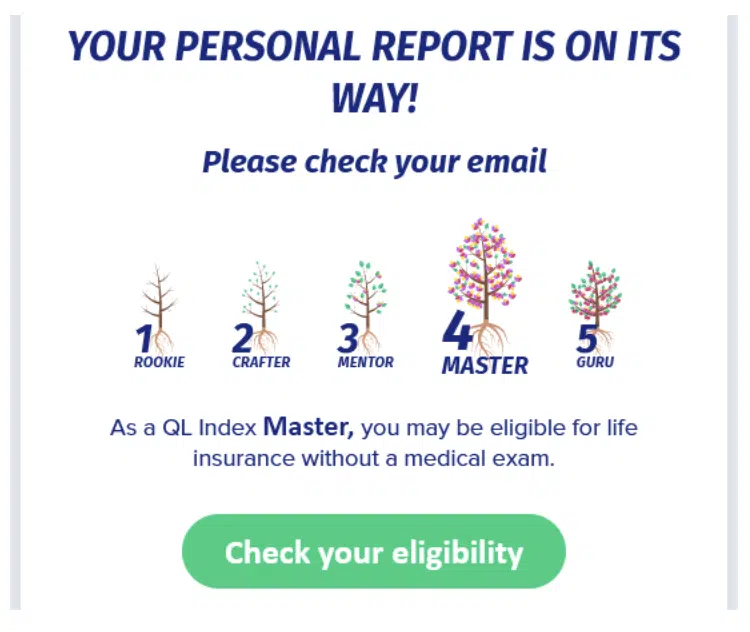

The next screen will provide your QL Index. I was classified as a “Master,” one of five categories.

Once you click “Check your eligibility,” you’ll be brought to the application process, with your QL Index being part of the recommendations you’ll be provided.

Unfortunately, when I completed the QL Index assessment, Sproutt’s system was undergoing a problem, so I got no immediate life insurance quotes.

But the important takeaway is that up to this point, I only completed the assessment – which is a requirement.

For the application, additional questions will be asked. Those include general questions, like family status, beneficiaries, address, date of birth, a health self-assessment, and other general questions.

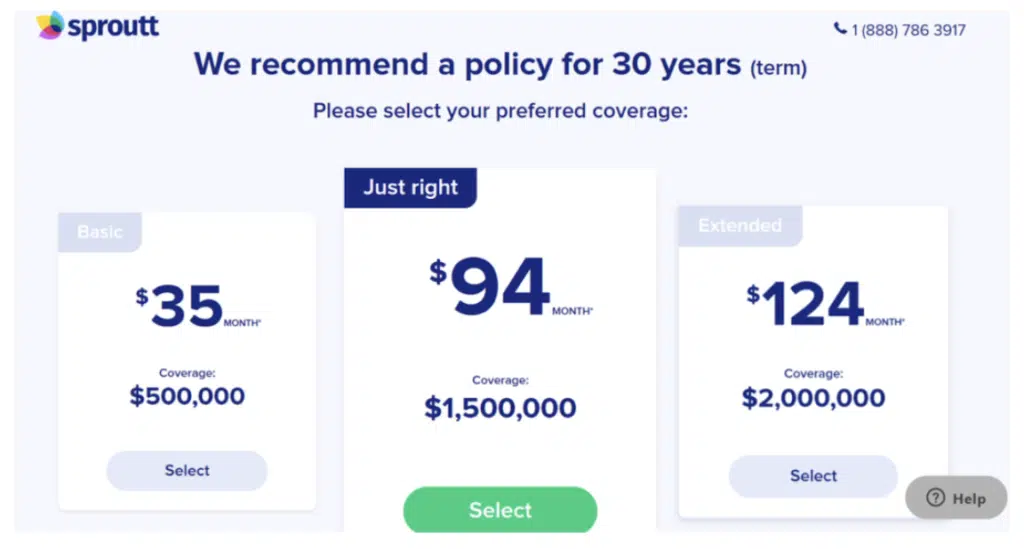

Once you complete that information, Sproutt will make a policy recommendation based on the answers to your questions.

Once again, Sproutt Life does not provide the actual policies (it’s an online life insurance marketplace). The participating life insurance companies will offer the policies on the platform.

Once you select the plan you like, the direct provider will likely have additional questions, and you’ll need to complete the application process through that company.

Obtain a Quote from Sproutt Today

How to Save Money on Life Insurance

No matter where you apply for life insurance, there are seven strategies you can use to save money in the process:

- Buy term life insurance vs. whole life. Whole life insurance is far more expensive than the equivalent term coverage. Go with term insurance and get a larger policy at a lower premium.

- Apply when you’re in good health. No single factor will have a greater impact on your premium – or even if you’ll be approved – than the condition of your health. That’s why it’s important to apply when your health is good.

- Maintain good health habits. Exercise regularly, eat a balanced diet, and see your doctor regularly.

- Maintain clean credit and good driving history. Insurance companies also check credit histories and driving records. The cleaner they are, the better your chance at a low premium.

- Choose a shorter term. If you’re going with term insurance, the premiums are lower on shorter terms. For example, a ten-year policy will be less expensive than a 20-year policy.

- Shop around. Never take a policy from the first provider that gives you a quote. Get three or four, then make your choice.

- Don’t wait! Many people put off buying life insurance until “later.” But because age is a major factor in determining premiums – and you’ll never be younger than you are right now – now is the time to apply for coverage.

Age is a major factor in determining life insurance premiums. You’ll never be younger than you are right now – now is the time to apply for coverage.

Obtain a Quote from Sproutt Today

Sproutt Life Insurance Review: Final Thoughts

Sproutt is an excellent choice if you’re beginning your search for life insurance. Because it’s an online life marketplace, you can get quotes from several major insurance companies with a single application.

Live customer support is a value add, given that Sproutt is an all-online platform. And if you’re proactive about your health, Sproutt captures that with their Quality of Life Index. It can help you track your progress and make improvements where needed.

But it’s also important to realize that, as an online life insurance source, Sproutt does focus its business on younger, healthier applicants.

If you’re older or have a significant health condition, you may still be able to get a policy through Sproutt, but you may be better served by working with an independent life insurance broker.

Otherwise, consider Sproutt if you’re looking to buy life insurance.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Sprout Life Insurance Product Description: Sprout Life Insurance is a life insurance policy that provides financial coverage to individuals in the event of their death. It can cover funeral costs, medical bills, and other costs associated with end-of-life expenses. It also provides beneficiaries with a lump sum payment that can help them cover living expenses in the wake of their loved one's passing. Summary of Sprout Life Insurance Sprout Life Insurance is a life insurance company that provides coverage options for individuals and families. The company offers both term and permanent life insurance policies, allowing customers to choose the coverage that best fits their needs and budget. In addition to life insurance, Sprout also offers a wellness program that provides discounts on gym memberships and healthy living products, further emphasizing their commitment to the health and well-being of their customers. Pros Cons

Sprout Life Insurance Review

Overall