When navigating the landscape of life insurance, one option often presented to working professionals is employer-provided life insurance. This benefit, typically classified as group life insurance, appears to be an alluring choice due to its integration into employee benefits packages and its perceived cost efficiency. However, when deciding whether or not to rely solely on this type of coverage, a thorough examination of its merits and limitations is crucial.

Table of Contents

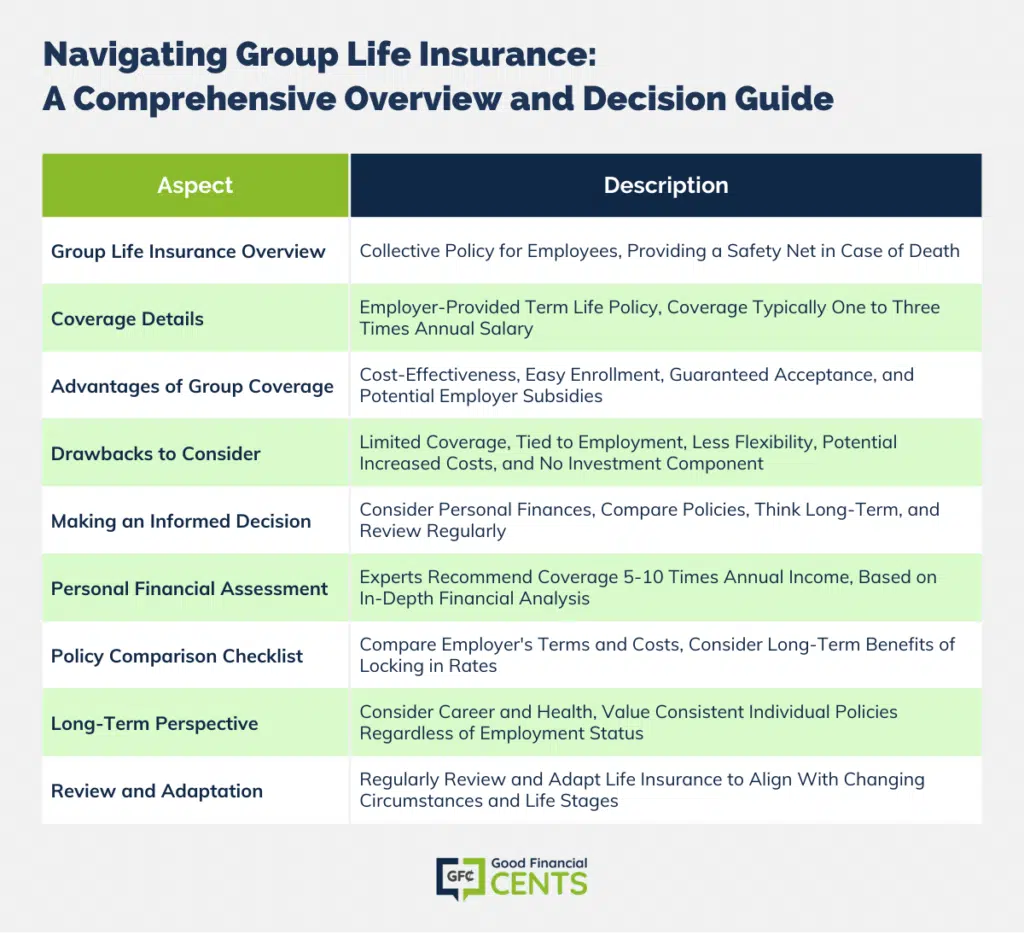

Unpacking Group Life Insurance

Group life insurance is a collective policy provided to employees under an employer’s umbrella. It’s designed to offer a base level of protection, which can serve as a safety net in the untimely event of an employee’s death.

A Closer Look at Coverage

Employer-provided life insurance typically includes a basic term life policy, which is active for the duration of employment. The standard coverage is often a multiplier of the employee’s annual salary, which can be anywhere from one to three times the amount.

Advantages of Opting for Employer-Provided Coverage

The benefits of opting into group life insurance are often linked to the ease and cost-effectiveness of obtaining coverage.

Cost-Effectiveness

Group plans capitalize on the principle of pooled risk. The insurer provides a blanket policy covering all participating employees, which can translate to lower individual costs due to the distributed risk factor.

Simplified Enrollment

Enrolling in a group life insurance plan is usually straightforward, requiring minimal paperwork. This hassle-free process is a significant draw for many employees.

Guaranteed Acceptance

The absence of medical underwriting means that coverage is guaranteed, regardless of health conditions. This aspect of group life insurance is particularly beneficial for those who might be denied an individual policy based on their health.

Employer Subsidies

Employers often subsidize a portion, if not all, of the premium for the basic policy, making it an even more economical choice for basic life insurance needs.

The Drawbacks of Employer-Provided Life Insurance

While group life insurance has its appeal, there are notable drawbacks that must be considered to determine if additional or alternative coverage is necessary.

Limited Coverage

A common pitfall of employer-provided life insurance is that the death benefit may be insufficient, particularly for those with substantial financial responsibilities such as a mortgage, dependents’ education, or significant debts.

Dependence on Employment

Reduced Flexibility

Group policies typically offer little to no opportunity for customization. Policyholders cannot tailor coverage to their individual needs or add specific riders like they can with individual policies.

Potential for Increased Costs

If supplemental coverage is purchased through the employer, premiums may escalate with age. Additionally, if the policy is portable and you leave your job, premiums can increase significantly.

No Investment Component

Unlike permanent life insurance policies, group life insurance does not have a cash value component or investment feature, which some individuals may desire as part of their long-term financial strategies.

Making an Informed Decision

With these factors in mind, it becomes clear that a careful evaluation is essential before deciding whether to purchase life insurance through your employer.

Personal Financial Assessment

An in-depth analysis of your financial situation and future goals should dictate the life insurance you need. Experts recommend coverage between five to ten times your annual income. A financial advisor can help you to calculate a more precise figure based on your unique circumstances.

Policy Comparison

It is advisable to compare the terms and costs of your employer’s life insurance policy against those available in the individual market. Sometimes, locking in a rate with an individual policy while you are young and healthy can be more beneficial in the long run.

Long-Term Perspective

Consider your long-term career trajectory, your health trajectory, and how these may affect your life insurance needs. Remember that an individual policy remains with you regardless of employment status, providing a consistent safety net.

Review and Adapt

Life insurance needs are not static; they change as life evolves. Regularly reviewing your life insurance coverage ensures that it stays aligned with your current needs and life stages.

Concluding Thoughts

Including life insurance within an employee benefits package is undeniably a valuable perk. For many, it provides a base layer of protection that is both cost-effective and convenient. However, it is essential to recognize the potential limitations and the risk of over-reliance on such employer-dependent benefits.

To achieve a robust financial plan, it is often prudent to supplement employer-provided life insurance with individual coverage. This dual approach ensures that you maintain adequate protection throughout various life events and employment changes.

By weighing the pros and cons and conducting a comprehensive assessment of your individual needs, you can make an informed decision that secures not just your peace of mind but also the financial well-being of those you care for, both now and in the future. With careful planning and foresight, life insurance—whether through an employer, purchased individually